In this article, You will read the What is Foreign Trade Policy of India, major initiatives under the foreign trade policy, and India’s new Foreign Trade Policy.

Foreign Trade Policy of India

- The foreign trade policy (FTP) outlines government strategies and steps to promote domestic production and exports to drive economic growth.

- India’s Foreign Trade Policy (FTP) provides the basic framework of policy and strategy for promoting exports and trade. It is periodically reviewed to adapt to the changing domestic and international scenario.

- It is essentially a set of guidelines for the import and export of goods and services.

- These are established by the Directorate General of Foreign Trade (DGFT), the governing body for the promotion and facilitation of exports and imports under the Ministry of Commerce and Industry.

- The Department of Commerce has the mandate to make India a major player in global trade and assume a role of leadership in international trade organizations commensurate with India’s growing importance. The Department devises commodity and country-specific strategy in the medium term and strategic plan/vision and India’s Foreign Trade Policy in the long run.

- The Department is also responsible for multilateral and bilateral commercial relations, special economic zones (SEZs), state trading, export promotion and trade facilitation, and development and regulation of certain export oriented industries and commodities.

- The Government, through the policy, primarily focuses on adopting a twin strategy of promoting traditional and sunrise sectors of exports including services.

- Further, it intends to simplify the process of doing business.

- While the trade policy covers both imports and exports, its primary objective is to facilitate trade by reducing transaction costs and time, thereby making Indian exports more globally competitive.

- The policy aims to

- Accelerate economic activity and make the most of global market opportunities

- Encourage sustained economic growth by providing access to raw materials, components, intermediates (goods used as inputs for the production of other goods), consumables and capital goods required for production

- Strengthen Indian agriculture, industry and services

- Generate employment

- Encourage stakeholders to strive for international standards of quality

- Provide quality consumer products at reasonable prices.

- Duration of the Policy

- The policy is notified for five years.

- It is updated every year on March 31, and the changes come into effect from April 1.

- India’s Foreign Trade Policy also envisages helping exporters leverage benefits of GST, closely monitoring export performances, improving ease of trading across borders, increasing realization from India’s agriculture-based exports, and promoting exports from MSMEs and labor-intensive sectors. The DoC has also sought to make states active partners in exports. As a consequence, state governments are now actively developing export strategies based on the strengths of their respective sectors.

- While the external environment has a major role to play in the success of export policies, it is also critical to address constraints within India including infrastructure bottlenecks, high transaction costs, complex procedures, constraints in manufacturing, and inadequate diversification in India’s services exports.

- India is a signatory to the Trade Facilitation Agreement (TFA) at the WTO, which will contribute to the simplification and lowering of transaction costs.

- According to current WTO rules as well as those under negotiation, India needs to eventually phase out subsidies and move towards fundamental systemic measures in the future. Under the Agreement on Subsidies, India has moved on from Annex VII countries of WTO on breaching the US$ 1,000 per capita income benchmark for 3 consecutive years in 2015.

- Around 70% of India’s exports constitute products that have just a 30% share in global trade. The government is looking at some more promising product groups like defense equipment, medical devices, agro-processing, technical textiles, and chemicals.

Major initiatives under the Foreign Trade Policy

Niryat Bandhu Scheme

- The Directorate General of Foreign Trade (DGFT) has come up with the Niryat Bandhu Scheme for mentoring budding exporters on the intricacies of foreign trade through counseling, training, and outreach programs.

- Given the rise of small and medium scale enterprises and their role in employing people, MSME clusters have been identified for focused interventions to increase exports.

- To achieve the objectives of the scheme, outreach activities are being organized in a structured manner with the assistance of Export Promotion Councils and other willing knowledge partners in academia and the research community.

- Besides, for the optimal utilization of resources, all the stakeholders will be attempted to be associated with, including Customs, ECGC, Banks, and concerned Ministries.

Duty-Free Import Authorisation (DFIA)

- It is a scheme under which duty-free import of inputs, fuel, oil, energy sources, a catalyst which is required for the production of export goods is allowed.

- Against such duty exemption, the importer is required to meet certain export obligations w.r.t. the finished goods.

- The minimum value addition of 20% is mandatory to be required to be achieved.

- This scheme is mainly used for imports of raw sugar to be used in producing an export product.

Export Promotion Capital Goods (EPCG)

- The objective of the EPCG Scheme is to facilitate the import of capital goods for producing quality goods and services and enhance India’s competitiveness.

- EPCG manufacturing Scheme allows import of capital goods for pre-production, production and post-production at Zero customs duty

- To apply for an EPCG scheme, an IEC is required

Electronic Import exporter code (IEC)

- Import exporter code is an export permit is mandatory for carrying out exports and imports from/to another country.

- DGFT has facilitated the online filing of the IEC application.

Electronic Bank Certificate (e-BRC)

- The initiative of e-BRC enables DGFT to capture essential details of the realization of export proceeds directly from the banks via secured electronic mode.

- This paves the way for the implementation of various export promotion schemes without any physical interface with the stakeholders.

Exporter Importer Profile

- Exporter importer profile is created to upload various documents, and to reduce the cost of transaction and time.

- One of the featured advantages of the system is that after the documents are uploaded, it isn’t necessary to submit the documents or copies of the same to Regional Authority repeatedly with each application.

Online Filing of Applications

- Thanks to digitization, the filing of applications has been made easier than ever before.

- The DGFT has facilitated the online filing of applications to obtain IEC and various Authorizations/scrip.

- The entity has introduced a web interface for the online filing of applications.

- The application can be paid online and the fees can be remitted through the banking facilities provided.

- The furnished applications are digitally signed and submitted electronically to the concerned Regional Authority of DGFT.

- Later it is electronically processed by the Regional Authority and Authorization /scrips are issued.

Withdrawal of Seizure of Export Related Stock

- Agencies should abstain from making any seizures as it stands in the way of the manufacturing activity and hampers the schedule of delivery.

- Certain agencies are still entitled to conduct the seizure based on prima facie evidence of serious irregularity, in which case the seizures should be withdrawn within seven days unless the defaults are substantiated.

Round-the-Clock Customs Clearance

- 24*7 customs clearance has been made available at 19 seaports and 17 air cargo complexes.

- In addition to it, Merchant Overtime Charges (MOT) need not be collected for the services provided by the Customs officers at 24*7 Customs Ports and Airports.

Single Window Interface

- Single Window Interface for Facilitating Trade (SWIFT) has been launched to facilitate the easier perusal of business.

- The system enables the importers to electronically lodge Integrated Declaration at a single point only with Customs.

- The necessary permissions are obtained from other regulatory agencies without physically approaching them.

Facilitating Export of Perishable Export Products

- To reduce the costs of transportation and handling, a single-window system has been introduced to facilitate the export of perishable agricultural produce.

- Under this system, multi-functional nodal agencies will be accredited by the Delhi-based Agricultural and Processed Food Products Export Development Authority (APEDA).

Time Release Study

- A time-release study is a unique tool created by the WCO for determining the actual performance of Customs.

- In addition, the tool helps in identifying bottlenecks in the international supply chain or constraints affecting Customs release.

- Indian Customs will now implement it at major Customs locations on a six-month basis.

Towns of Export Excellence (TEE)

- Specified towns with a goods turnover of Rs 750 Crore or more may be notified as TEE based on their export potential.

- Handloom, handicraft, agriculture, and fisheries sector will have a threshold limit of Rs 150 Crore.

- TEE’s will be provided with the following benefits:

- Recognized associations of units will receive financial assistance under the MAI scheme on a priority basis, for export promotion projects in marketing, capacity building, and technological services.

- Common service providers in these areas will be considered eligible for Authorization under the EPCG scheme.

New Foreign Trade Policy 2021-2026

- The FTP 2015-20 came into effect on the 1st of April 2015 and the same was extended by one year till 31 March 2021, due to the Covid-19 pandemic.

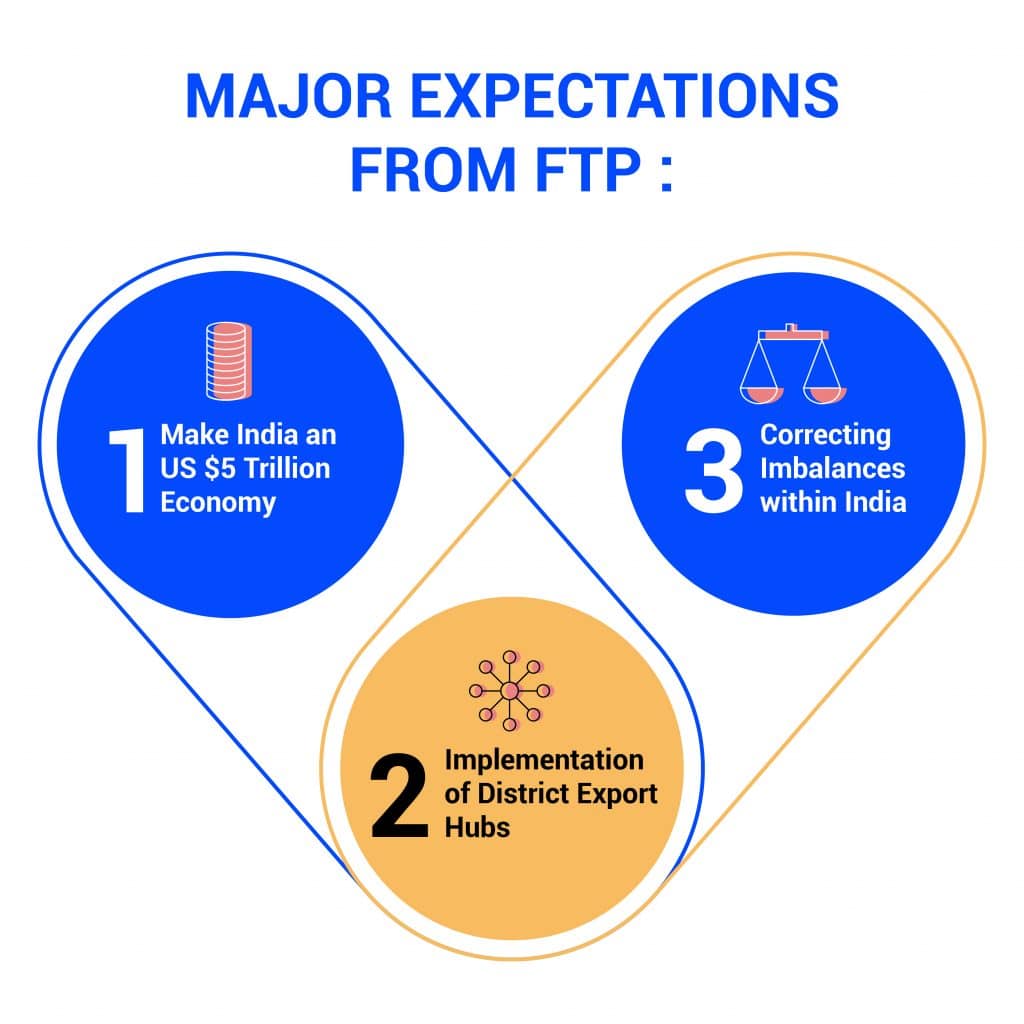

- New Foreign Trade Policy 2021-26″. which have come into effect from 1st April 2021 for a period of five years and will strive to make India a leader in the area of international trade and channelize the synergies gained through merchandise and services exports for growth and employment with a goal to make India a USD 5 Trillion economy.

- District Export Hubs Initiative will form an important component of the new Foreign Trade Policy. The Department of Commerce through the Regional Authorities of DGFT has engaged with State/UT Governments to take forward this initiative in the districts and enable its implementation in a phased manner, with the objective of mobilizing the potential of each district of the country to achieve its potential as an export hub.

What are the expectations from FTP 2021-2026?

- WTO-compliant tax incentives

- With incentives under MEIS and SEIS under a cloud, the need of the hour is WTO-compliant tax benefits.

- To this end, the government has announced the Remission of Duties or Taxes on Export Products (RoDTEP) scheme, effective January 1, 2021.

- It replaces MEIS.

- Rates and conditions for the new scheme are yet to be announced.

- Easy credit access

- A long-standing demand of exporters, especially MSMEs, is credit access.

- Formal financial institutions such as banks are reluctant to lend to MSMEs due to their lack of adequate collateral.

- The policy can help open up alternate credit avenues

- The advisory group suggests raising borrowing limits at the Export-Import Bank of India.

- Infrastructure upgrade

- One reason why China is a manufacturing and export powerhouse is its network of ports, highways, and high-speed trains, which are among the best in the world.

- India needs to learn from its neighbor and improve its flagging infrastructure by upgrading existing ports, warehouses, quality testing, and certification centers and building new ones.

- The Trade Infrastructure for Export Sector, a scheme for developing infrastructure to promote exports, was launched in 2017 for three years.

- Many in the industry hope it will be extended.

- Less subsidy, more support

- In 2020, Commerce Minister Piyush Goyal said quality, technology, and scale of production were the answers to India’s global ambitions, not subsidies.

- Many in the industry agree, saying government support in the form of skill development programs and technological up-gradation rather than subsidies would help them become more competitive.

- Pharmaceuticals, biotechnology, and medical devices are some sectors that could do with upskilling.

- Similarly, the trade policy could include incentives with a focus on research and development, something the government has spoken of in the past.

- On the technology front, the Amended Technology Upgradation Fund Scheme – which facilitates improvements in investment, productivity, quality, and exports in the textile industry through technology upgrades – can be replicated for other sectors.

- Tax breaks

- If India were to do away with subsidies, exporters would still need some form of government support.

- Easier and lower taxes are a way of filling this gap.

- The reduction of corporate tax rates and simplification of duty structures are long-standing demands.

- The Confederation of Indian Industry (CII) suggests simplifying the import duty structure by following “the general principle of higher duties on finished goods and lower/minimal duties on intermediates and raw material”.

- There are also demands for an overhaul/improvement of existing schemes such as the EPCG and Duty Drawback Scheme.

- Digitization and e-commerce

- With Covid-19 disrupting traditional supply chains, India needs modern trade practices.

- Digitization and e-commerce are two ways to go about this.

- Digitization can start with making common import-export processes paperless.

- Trade body Nasscom, for example, recommends an online mechanism for Importer Exporter Code (IEC) holders to change their particulars (mobile numbers, e-mail IDs, etc).

- It also makes a case for encouraging e-commerce exports by

- Including e-commerce export platforms under Niryat Bandhu (a scheme for mentoring entrepreneurs in international trade)

- Establishing e-commerce export promotion cells within export promotion councils

- Establishing e-Commerce Export Zones to promote MSMEs.

- Export awareness

- At times, Indian exporters are defeated not by a lack of trade opportunities but by a lack of awareness of the same.

- The trade policy can make a provision for government workshops and awareness programs that educate and inform traders about international laws and standards, global markets, intellectual property rights, patents, and geographical indication (GI).

- Import wishlist

- While most of the expectations might be geared towards exports, India’s import community has its wishlist too, which includes permission to import capital goods on a self-certification basis and to import prohibited items with the approval of the Central government-approved Board of Approval or Inter-Ministerial Standing Committee.

Road to $5 Trillion by 2025

- India aspires to be a $5-trillion economy by 2025. To achieve this dream, it needs to:

- Register a GDP growth rate of 8% or more in the next few years

- Triple its exports to $1 trillion by 2025.

- This is a tough task, considering Indian exports have hovered around the $300-billion mark since 2011-2012. Battered by the pandemic, exports for the April-November 2020 period stood at $304.25 billion. The country’s GDP reached $ 2.88 trillion in 2019–2020.

- In its 2019 report on what India must do for exports to reach $1 trillion by 2025, the high-level advisory group suggested:

- Urgent reform of labour laws

- Easing of regulatory controls

- Lowering the cost of capital

- Selection of right trading partners (given India’s unhappy experience with FTAs)

- Sector-specific strategies to drive exports, especially in pharma, biotechnology, textiles and electronics.

- The formation of a special committee to take quick decisions on foreign direct investment (FDI), including identifying and attracting potential investors.

- The government, on its part, seems committed to seriously working towards its $5-trillion dream. Briefing MPs about FTP 2021-2026 on January 12, the Ministry of Commerce announced some of its plans for the new policy. These include:

- District Export Hubs: The government will identify potential products and services in each district, identify agricultural and toy clusters, map GI products, set up district export promotion panels and district export action plans as part of this initiative targeted at small businesses and farmers.

- Correcting imbalances: A persistent demand of exporters/importers is correcting the imbalances in India’s international trade processes. At the meeting, the ministry committed to reducing “domestic and overseas constraints related to the policy, regulatory and operational framework for lowering transaction costs and enhancing the ease of doing business”. It also spoke of creating “efficient, cost-effective and adequate logistical and utility infrastructure”.

- If FTP 2021-2026 delivers on the government’s commitments and lives up to the industry’s expectations, India as a $5-trillion economy is not a dream too far.

Thanks a lot your effort to prepare these answers & notes are great

nice initivative

Most Welcome, Happy Learning.

Why did you make your content paid sir?