In this article, You will read the Growth and development, Locational factors, and distribution of the Automobile Industry in India – for UPSC IAS (Industry – Geography of India).

Automobile Industry in India

- The automobile is made up of two-word auto(self)+ Mobile( movable). Automobile refers to self movable vehicles without the help of man or animal force. The automobile vehicle is used for transportation of goods and passenger by various means Road, track, water, or airway.

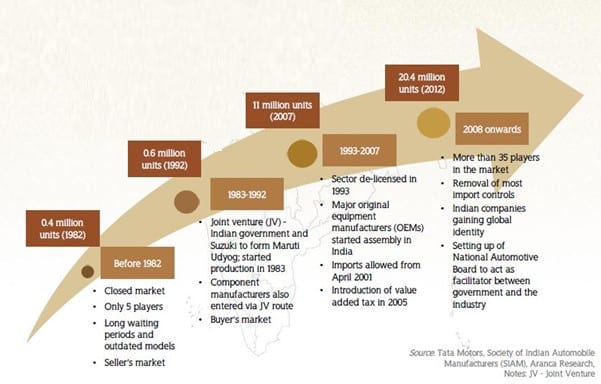

- Automobile industry did not exist in India in the real sense before Independence. Only assembly work was done from the imported parts. General Motors (India) Ltd. started assembling trucks and cars in 1928 in their factory at Mumbai.

- Ford Motor Co. (India) Ltd. started assembling of cars and trucks at Chennai in 1930 and at Mumbai in 1931.

- The real development of the industry began with the establishment of the Premier Automobiles Ltd. at Kurla (Mumbai) in 1947 and Hindustan Motors Ltd. at Uttarpara (Kolkata) in 1948.

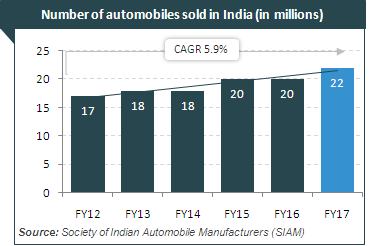

- Automobile industry in India has made considerable progress during the last three decades. Today, it is one of the most vibrant sectors of the economy.

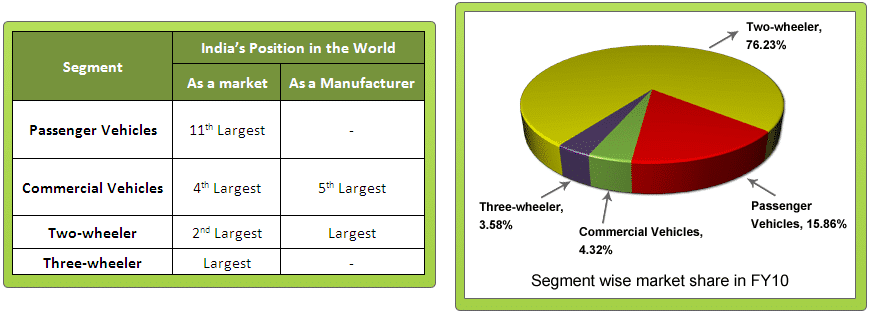

- With the gradual liberalization of the automobile industry since 1991, more and more players have set up manufacturing facilities in India. At present, there are 15 manufacturers of passenger cars and multiutility vehicles, 9 manufacturers of commercial vehicles, 14 of two/three-wheelers, and 14 of tractors besides 5 manufacturers of engines. The industry has an investment of more than Rs. 50,000 crore.

- During the year 2003-04 the turnover of the automobile sector exceeded Rs. 1, 00,000 crores. The industry also offers substantial employment potential. Currently, it provides 4.5 lakh direct employment and about one crore indirect employment. The contribution of the Auto Industry to GDP has risen from 2.77 percent in 1992-93 to 4.7 percent in 2002-03.

Location factors of Automobile Industry

- Automobile Industry usage finished product of metallurgical industry as raw materials and produce automobile vehicles.

- The automobile industry requires a large variety of raw materials from other industrial sources viz. steel, nonferrous metals, window-glass, plastic, rubber, wood, paint, textile, electronic cables, seat cushions, etc.

- To continue mass production on the assembly line, you need a continuous supply of those spare parts, raw materials.

- The automobile industry tends to be located near iron and steel producing centers because steel is the basic raw material used in this industry. The proximity of places producing tyres, tubes, storage batteries, paints, and other ancillary industries is considered to be an added advantage.

- Port cities also find favor with this industry because of the import and export facilities offered by such places.

- Of late, the automobile industry has become market-oriented and prefers those locations which offer ready markets for manufactured vehicles.

- Government Policy: Under the Government’s plans for decentralization of industries, some locations in remote and industrially backward areas are given priority.

- Cheap Labor availability.

Production and Distribution

- The commercial vehicles industry is divided into two broad segments, viz., passenger and goods.

- The passenger segment is largely controlled by state-owned transport undertakings (STUs) while goods vehicles are generally manufactured in the private sector.

- The manufacture of commercial vehicles started in the 1950s and the industry registered rapid growth in the past-liberalization period as a result of incentives given by the government.

- The production of commercial vehicles (including buses, trucks, tempos, 3 and 4 wheelers) increased from an insignificant of 8.6 thousand in 1950-51 and to 145.5 thousand in 1990-91 and 327.3 thousand in 1996-97. However, varying trends in production have been observed after 1996-97. In the year 2003-04, India produced 275.1 thousand commercial vehicles.

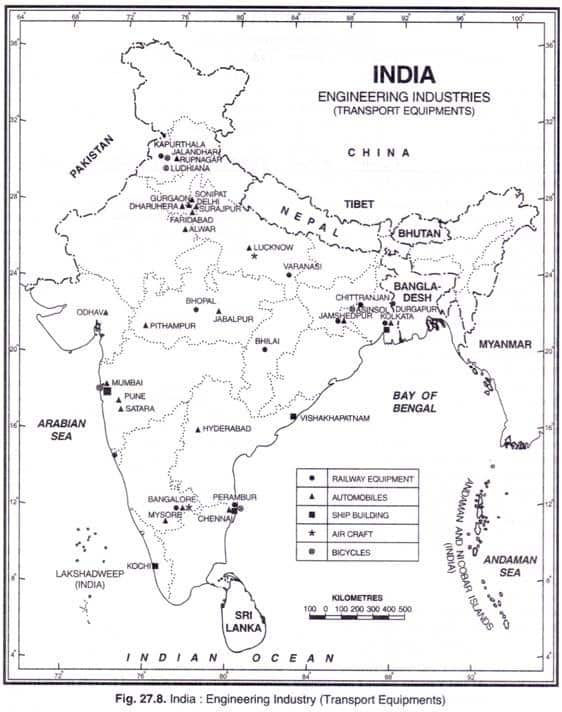

- Currently, 7 major companies are engaged in manufacturing buses and trucks. Tata Engineering and Locomotive Co. Ltd. (TELCO) is the leading producer of medium and heavy commercial vehicles and accounts for over 70 percent of such vehicles produced in India. Four plants, each at Hyderabad, Pithampur (M.P.), Arson near Rupnagar (Punjab), and Surajpur in U.P. manufacture light commercial ‘vehicles.

- Premier Automobiles and Mahendra and Mahendra are located in Mumbai, Ashoka Leyland Ltd. and Standard Motor Products of India Ltd. are located in Chennai, Hindustan Motors Ltd. is at Kolkata, and Bajaj Tempo Ltd. is located in Pune.

- In addition to the above-mentioned manufacturers, Shaktiman trucks are manufactured under the Ministry of Defence and Nissan Jeeps at Jabalpur in collaboration with the Nissan of Japan.

Passenger Cars:

- A number of companies are engaged in manufacturing passenger cars. Of these, Maruti Udyog Ltd. (MUL) is at the top. It is located at Gurgaon in Haryana. It started production in 1983 with the collaboration of Suzuki Motor Corporation of Japan. Currently, this company produces about four-fifths of the total cars produced in India.

- It produces a variety of models of which Maruti 80, Zen, Wagon R, Esteem, and Gypsy are very popular.

- Hindustan Motors (Kolkata and Chennai), Premier Automobiles (Mumbai), Standard Motor Products (Chennai), and Sunrise Industries (Bangalore) are other important producers.

- Several new companies have entered the car manufacturing industry of India after liberalization in 1991. These include Hyundai Motors India at Irrungattukottai in Kanchiura district (Tamil Nadu), Daewoo of Korea in 1995 at Surajpur (Uttar Pradesh), Telco at Pimpri (near Pune). Honda of Japan has set up a plant in Uttar Pradesh to manufacture ‘City’. General Motors has launched Opel Astra. It has a tie-up with Hindustan Motors.

- Ford in collaboration with Mahindra has introduced Ford.

- Hindustan Motors in collaboration with Mitsubishi of Japan has launched ‘Lancer’.

- Mercedes Benz of Germany in collaboration with Telco is manufacturing E220 and 250D for the upper strata of society.

- Premier Automobiles in collaboration with Fiat-India Auto Limited is manufacturing the Fiat Uno model.

- Table 27.19 shows that the car manufacturing industry made rapid progress particularly after Maruti Udyog Limited (MUL) started production in the mid-1980s. The production of passenger cars increased from 390.7 thousand in 1998-99 to 842.4 thousand in 2003-04.

| Category | 1998-99 | 1999-00 | 2000-01 | 2001-02 | 2002-03 | 2003-04 |

| Passenger car | 3,90,709 | 5,77,243 | 5,13,415 | 5,64,052 | 6,08,851 | 8,42,437 |

| Multi Utility Vehicles | 1,13,328 | 1,24,307 | 1,27,519 | 1,05,667 | 1,14,479 | 1,46,103 |

| Commercial Vehicles | 1,35,891 | 1,73,521 | 1,56,706 | 1,62,508 | 2,03,697 | 2,75,224 |

| Two Wheelers | 33,74,508 | 37,78,011 | 37,58,518 | 42,71,327 | 50,76,221 | 56,24,950 |

| Three Wheelers | 2,09,033 | 2,05,543 | 2,03,234 | 2,12,748 | 2,76,719 | 3,40,729 |

| Total | 42,23,469 | 48,58,625 | 47,59,392 | 53,16302 | 62,79,967 | 72,29,443 |

- The production of cars (including jeeps and land rovers) recorded more than a hundred percent increase in a short span of six years from 220.8 thousand in 1999-91 to 483.0 thousand in 1996-97. After a brief slack period of 1997-98 and 1998-99, the production again picked up in 1999-2000 and stood at 1,008.1 thousand in 2003-04.

- Several factors have made it a buoyant industry in the recent past and the industry has a bright future. Reduction in excise duty on passenger cars from 32 to 24 percent in 2004 has led to reduced car prices and created the potential for an increase in demand.

- This has helped in the growth of the industry to a great extent. The government’s Auto Policy also has the stated aim of making India an ‘Asian hub’ for the manufacture of small cars. The small car segment, which refers to the A and В segments, accounts for over 65 percent of the market. Giving a further push to this segment, therefore, adds impetus to a movement that is already underway. For India to become a large manufacturer of small cars, quality and price are the two basic deciding factors.

- The potential for growth is good considering that passenger car penetration in India is a mere 20 cars per 1,000 population whereas it is much higher in other developing countries. The market is projected to grow at a rate of around 7 percent annually.

- Over the years car sales in the A and В segments category as a whole have registered a steady growth because these cars are available in a wide range of models and at affordable prices. The mid-size category normally pertains to С segment cars. This segment accounts for 15-16 percent.

- In addition to varied models and affordable prices, various finance options have also grown with the automobile industry.

- There were times when a car loan meant tedious trips to the bank, reams of paperwork, and long waiting periods for requisite approvals from the sanctioning authority. Today the scenario is quite different, with customers having fast access to very flexible financing options that suit their different needs. Attractive automobile financing schemes have definitely boosted sales of passenger cars. Today, almost 70 percent of new cars are financed through auto loans.

Jeeps:

- Almost the entire production of jeeps comes from Mahindra, Mumbai. It has a capacity to produce about 13,000 jeeps per annum.

Two Wheelers:

- Two-wheeler industries mainly comprise motorcycles, scooters, mopeds, and scooterettes. The Indian two-wheeler industry made a humble beginning in the early 1950s when Automobile Products of India (API) started manufacturing scooters in the country. Until 1958, API and Enfield were the sole producers. In 1960, Bajaj Auto set up a plant in collaboration with Pioggio of Italy.

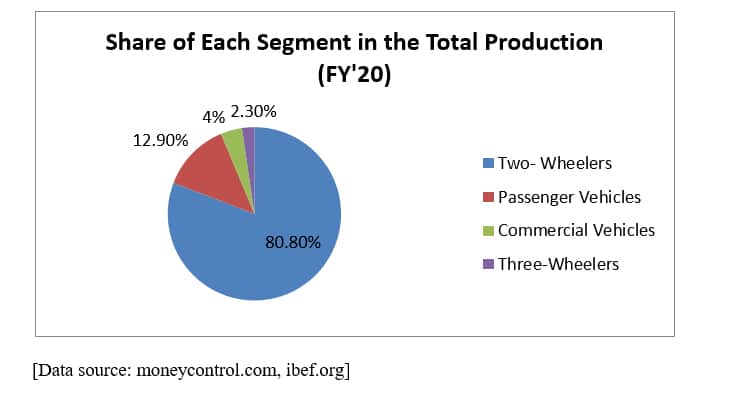

- Two-wheeler industries have also made rapid strides. It came a long way from an insignificant production of 0.9 thousand units in 1960-61 to 5,624.9 thousand units in 2003-04. The two-wheeler market was opened to foreign competition in the mid-1980s. Practically, all the global giants have been present in India for quite some time.

- The first to come was Suzuki Motor Corporation with TVS in 1984. Honda followed within a year, in a joint venture with Hero Group. Then Kawasaki and Yamaha entered into a license agreement with Bajaj Auto and Escorts respectively.

- Piaggio has joined up with LML which is planning to expand its capacity to six lakh vehicles per annum. Bajaj Auto is expanding its capacity to two million vehicles per annum. Hero Honda is expanding its Dharuhera plant capacity to over 2, 52,000 vehicles a year and has set up a plant at Gurgaon with an investment of Rs.160 crore.

- TVS Suzuki plans to invest Rs. 200 crores to expand its production capacity to one million vehicles per annum. Yamaha-Escorts, a joint venture has also announced plans to introduce a new range of products and expansion facilities in its Surajpur plant. Mumbai, Pune, New Delhi, and Kanpur are the main centers of scooter manufacturing. Public sector units are located at Hyderabad, Bangalore, Satara, Lucknow, and Alwar. Motorcycle-producing units are located in New Delhi, Chennai, Mysore, and Gurgaon.

- The dynamics of the two-wheeler industry in India makes fascinating reading. From a semi-luxury product for the urban middle class in the 1980s and earlier, the two-wheeler has now become not only the favorite form of personal transport but also the most coveted personal possession among various consumer classes except perhaps the most affluent.

- Leading this emergent boom has been the stylish fuel-efficient and sturdy four-stroke motorcycle that seems to be equally at home on highways and rural byways. In addition, economically active and ambitious consumer class, the relative youth of the population, the substantially lower cost of two-wheelers (as compared to cars) as well as its inherent attractiveness, especially to the young male population have played a crucial role.

- Today with annual sales of over 5 million units, the Indian two-wheeler market is the second-largest market in the world after that of China (annual sales of 12.5 million units).

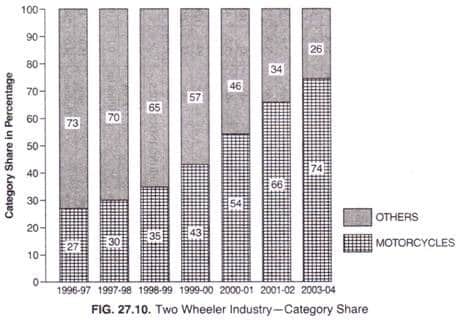

- Technically, the two-wheeler industry is divided into five major classifications: mopeds, motorcycles, scooters, step thrust, and ungeared scooters. Of all the two-wheelers, motorcycles have registered the maximum growth.

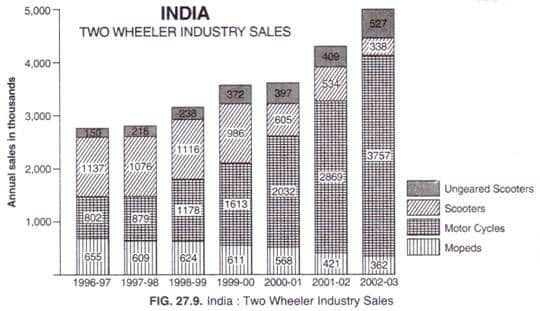

- In fact, motorcycles are the fastest-growing segment, with scooter and moped volumes seeing a steady decline. The sale of motorcycles registered a more than fourfold increase in a short span of six years. It increased from 802 thousand units in 1996-97 to 3,757 thousand units in 2002-03.

- In contrast, the sale of scooters declined from 1,137 thousand units in 1964-97 to only 338 thousand units in 2002- 03 Similarly the sale of mopeds was reduced to about half from 655 thousand units in 1996-97 to 362 thousand units in 2002-03 (see Fig. 27.9).

- While sales of all other product categories declined motorcycles grow at a robust 31 percent in 2002-03 and represented 74 percent of all two-wheeler rates as against just 27 percent in 1996-97 (see Figure 27.10). While scooter sales have predominantly been in urban areas, motorcycle sales are split 50: 50 among urban and semi-urban/rural areas.

- Like the passenger car industry, the two-wheeler industry has also gained a lot from the availability of easy finance. Financing was a rare phenomenon till the early 1990s but increased fourfold between 1996-97 and 2003-04. Though only 35-45 percent of two-wheeler sales are financed now, this proportion has moved up from 15 percent in 1999-2000.

- Two-wheelers are the most effective safety valve which relieves pressure on urban personal transportation. More than 65 percent of the two-wheeler population is concentrated in urban and semi-urban areas. With public transport being scarce in most cities of India, the two-wheelers offer a convenient alternative.

- The demography of the Indian population is skewed in favor of the younger generation, which prefers two-wheelers. Therefore, the scope of further growth of the industry is great. The younger generation in the age group of 15-34 years comprised 35.1 percent of the population as per 2001 census figures, and this is expected to increase in the near future.

- The office-going middle class (typically in the age group of 25 and 59 years) which prefers motorcycles on account of fuel economy, formed 23.5 percent of the population in 2001, and this is expected to increase further in the near future. Consequently, this segment in expected to progress rapidly in the next ten years.

- Although India is the second-largest two-wheeler market in the world after China, the penetration levels are low at 38 per thousand people, compared to Indonesia (75), Thailand (150), and Malaysia (220). Thus there is ample scope for this industry to grow fast.