In this article, You will read the Liberalisation, Privatisation, and Globalisation – for UPSC (Industry – Geography of India).

Liberalisation

- Liberalization of the economy means its freedom from direct or physical controls imposed by the government.

- After launching its First Five Year Plan (April 1, 1951), India started its journey to economic development treading the path of the socialistic pattern of society. Between 1st to 6th five-year plans, the public sector was assigned the primary role in the process of growth and development. For example, the setting up of BHEL in the 1960s and NTPC in the 1970s.

- The private sector was to play only a secondary role. Industry and trade were subjected to many restrictions including quotas of production and permits of export and import. The focus was on protecting the domestic industry from international competition.

- However, the growth of private monopolies was to be curbed. It is not denying the fact that initially, the policy of licenses, permits, and quotas yielded some good results, but the end result was disappointing. While public sector enterprises became the breeding centers of corruption and inefficiencies, the private sector (in the absence of competition), failed to diversify or modernize.

- The cumulative effect was that our economy started slipping into stagnation, and by the end of June 1991, we landed into an unprecedented economic crisis. The situation was so alarming that our reserves of foreign exchange almost dried up and were barely enough to pay for two weeks’ imports. New loans were not available.

- The following observations highlight the seriousness of the situation and the need for economic reforms:

- Fiscal Deficit: Fiscal deficit was estimated to be 5.4 percent of GDP in 1981-82 to shot up 8.4 percent of GDP in 1990-91

- Balance Of Payments (BoP) Crisis: In 1980-81, the balance of payments on the current account was adverse to the tune of Rs. 2,214 crore and in 1990-91 it rose to Rs. 17,367 crore. Foreign loans which were 12 percent of GDP (gross domestic product) in 1980-81, rose to 23 percent of GDP in 1990-91. Accordingly, the burden of foreign debt service increased tremendously. In 1980-81, foreign debt service constituted 15 percent of our export earnings while in 1990-91, it rose to 30 percent. This caused a severe depletion in our Forex reserves and crises of confidence in the international foreign exchange market

- Gulf Crisis: On account of the Iraq war in 1990-91, prices of petrol shot up. India used to receive a huge amount of remittances from Gulf countries in foreign exchange. In the wake of war, this took a serious hit. The Gulf crisis thus further deepened the BoP crises.

- Fall in Foreign Exchange Reserves: In 1990-91, India’s foreign exchange reserves fell to such a low level that there were not enough to pay for an import bill of even 10 days. In such a state of crisis, the government had to helplessly resort to the policy of liberalization as advised by the World Bank.

Why India waited till 1991 to open its doors?

- India after independence put barriers on foreign trade and investments as it was felt that it was necessary to protect the producers within the country from foreign competition. It was felt that imports would not have allowed these industries to come up.

- Strict restrictions were imposed, except on essential items like petroleum products, capital goods, and fertilizers, etc. This is in tune with the protection offered by the developed countries also, during their early stages of development.

- Situation during the 1980s till 1991

- There is a feeling that the mixed economy framework followed since independence resulted in the establishment of a variety of rules and laws, which ultimately resulted in permit license raj.

- During 1990/1991 government was not in a position to make repayments on its borrowings from abroad.

- In 1990-91, India’s foreign exchange reserves fell to such a low level that these were not enough to pay for an import bill of even 10 days. Forex reserves that were Rs. 8,151 crore in 1986-87, declined sharply to Rs. 6,252 crore in 1989-90.

- Government’s expenditure was much higher than revenue during the 1980s and continued spending on development programs did not generate additional revenue.

- Government could not sufficiently generate income from internal sources like taxation. Larger share of expenditure has gone to areas like the social sector and defense.

- In 1951, there were just 5 enterprises in the public sector in India but in March 1991, their number multiplied to 246. Several thousand crores of rupees were invested in their expansion. In the initial 15 years, their performance was encouraging but thereafter most of these started showing losses. Because of their poor performance, public sector undertakings degenerated into a liability.

- Money borrowed from foreign Governments/ multinational institutions was spent for meeting the consumption needs of the government.

- At one stage, there was not sufficient foreign exchange to pay the interest that needs to be paid to international lenders.

- India approached international financial institutions like IBRD, IMF for loans and while granting loans, the international agencies wanted India to liberalize and open up the economy by removing restrictions on the private sector and at the same time reduce the role of the government in many areas.

- This ultimately led to the New Economic Reforms of 1991

Globalisation and Liberalisation

- The process of removing barriers of trade is called liberalisation and removal of trade barriers results in the phenomenon of globalisation. Globalization is primarily economic phenomenon, involving the increasing interaction, or integration, of national economic systems through the growth in international trade, investment, and capital flows.

- Liberalisation was introduced to end up the trade restrictions and open up various sectors of economy.

- There were some measures in 1990 in areas of industrial licensing, export import policy, technology up gradation, fiscal policy and foreign investment, but they were not sufficient.

- Under New Economic Policy 1991, major reforms were initiated, which were comprehensive.

Features of Liberalisation

- Industrial Sector Reforms under Liberalization:

- Scenario till 1991:

- Industrial licensing under which every businessman had to get permission from the government officials to start a firm or close a firm.

- Government permission was also required to decide the number of goods that could be produced

- The private sector was not allowed in many industries

- Some goods could be produced only in small scale industries

- The government used to control prices and distribute selected industrial products, which led to corruption.

- Scenario since 1991:

- Many of the restrictions as stated above were removed.

- Industrial licensing was removed for almost all the products except for the following five industries: (a) liquor, (b) cigarette, (c) defense equipment, (d) industrial explosives, and (e) dangerous chemicals.

- Under the new industrial policy, the number of industries reserved for the public sector was reduced from 17 to 8. In 2010-11, the number of these industries was reduced merely to two viz. (i) Atomic energy, and (ii) Railways.

- Many production areas which earlier were reserved for SSI (small-scale industries) were de-reserved. Forces of the market were allowed to determine the allocation of resources (rather than the directive policy of the government).

- In many industries, the market has been allowed to determine the prices.

- Scenario till 1991:

- Financial Sector Reforms (major reforms since 1991):

- Liberalization implied a substantial shift in the role of the RBI from ‘a regulator’ to ‘a facilitator’ of the financial sector.

- Private sector banks like ICICI, Kotak, HDFC, etc, both domestic and international, were established.

- Gradually FDI and FPI limits were increased in various sectors.

- Banks were allowed to generate resources from India and abroad

- Several reforms were brought in insurance, money and capital markets, etc.

- New institutional regulators and structures such as SEBI, BSE, NSE, PFRDA, and IRDA were erected in the face of new realities of the Indian financial sector.

- Tax Reforms (major reforms since 1991):

- Since 1991, there has been a continuous reduction in the taxes on individual income.

- It was felt that high rates of income tax were an important reason for tax evasion and hence moderate tax rates in income tax, as well as corporate tax, are introduced.

- Many procedures have been simplified

- Reforms have been introduced in indirect taxes and the most recent one is Goods and Service Tax (GST).

- Foreign Exchange Reforms:

- Rupee was devalued against foreign currencies. It was done basically to increase exports and ultimately to build up foreign exchange reserves

- Devaluation of the Indian rupee against foreign currencies increased the supply of foreign exchange into the Indian economy.

- Subsequently, demand, and supply of foreign exchange determined exchange rates and Government’s intervention is quite minimal in this aspect. Rarely RBI intervenes, which is known as ‘managed float’.

- Trade and investment policy reforms:

- Gradually quantitative restrictions on imports were eased.

- Import licensing was abolished except in the case of hazardous and environmentally sensitive industries.

- Quantitative restrictions on imports of manufactured consumer goods and agricultural products were also fully removed from April 2001.

- Export duties have been removed to increase the competitiveness of the Indian goods in the international markets.

- FDI/FPI liberated gradually.

- Disinvestment

- Disinvestment and Privatization are two different terms in a technical sense, though both involve the sale of the Government’s share in the Public Sector Undertakings. The term privatization is used for a stake sell in which there is a transfer of 51% or more equity to the private players. In disinvestment, the government sells only a part of the equity which is essentially less than 51% so that ownership and management rights can behold by the Government itself.

- The method of disinvestment in India changes from time to time, mostly depending on the party at the center.

- There are primarily 2 different approaches to disinvestments

- Minority Disinvestment: Minority disinvestment in PSUs is such that, at the end of it, if the government of India retains a majority stake (typically more than 51%) in the company, it ensures management control.

- Strategic Sale: It is the sale of a substantial portion of government shareholding, 50 percent or higher, in a PSU, along with the transfer of management control. It is in contrast with the minority sale where shares in an enterprise are sold as public offers. Here management goes out of the government’s hands and the government becomes a minority stakeholder.

Privatisation

- Privatization means a transfer of ownership, management, and control of public sector enterprises to the private sector. It is of two types:

- Privatisation by the withdrawal of the government ownership and management i.e. coming out of majority control of public sector companies.

- Privatisation by the outright sale of public sector companies.

- Most of the profitable undertakings were originally formed during the 1950s and 1960s when self-reliance was an important element of public policy. They were set up with the intention of providing infrastructure and direct employment to the public.

- Subsequently, the government gave more managerial and operational autonomy by declaring them as Navaratnas, Minratnas etc. However, the privatization of public sector enterprises could not take place on the desired lines, and probably this is one of the failures of the Government’s New Economic Policy of 1991.

Globalisation

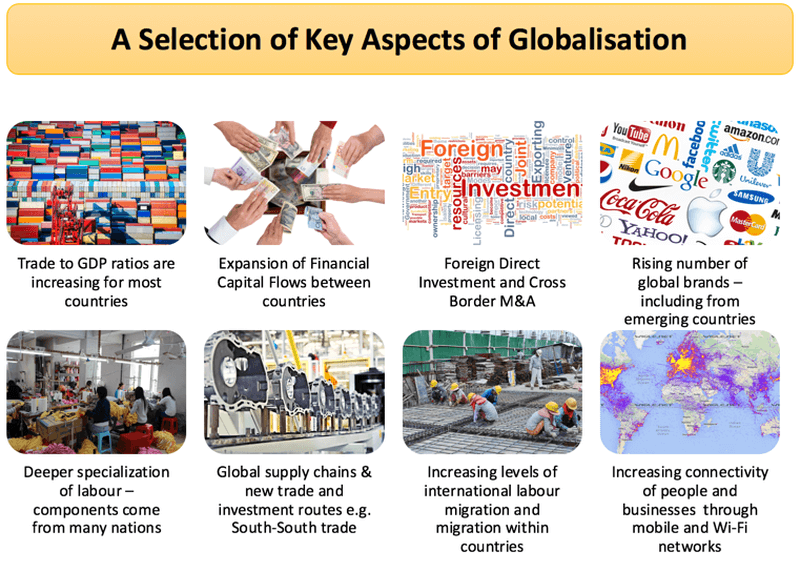

- Globalization is seen as a process defining the growing interdependence between various economies of the world. The term is also used specifically for economic globalization which stands for aligning regional economies with the global economies through the vehicle of trade, FDI, the flow of capital, technological advancement, and also wide-scale migration.

- It was only after the economic liberalization in 1991, Indian economy tasted the freedom of trade induced by globalization in a real sense.

- Globalisation is the outcome of the policies of liberalization and privatization.

- It is the free movement of trade, investment, people, services, and technologies across the countries boundaries (with some controls).

- It is a complex phenomenon and various commercial activities are being undertaken in places, where it is cheaper to do so.

- It has led to the greater interdependence and integration of economic activities across the globe.

- It involves the creation of networks and activities transcending economic, social, and geographical boundaries. Thus, happening in one country can be influenced by happening in another country.

- The complex web of globalization can be understood by the fact that today company like Apple does its R&D work in the USA, manufactures its components in China, imports some accessories from Thailand, assembles its components in Poland, and have its call centers in India.

Outsourcing- An offshoot of Globalisation

- Outsourcing occurs when a company retains another business to perform some of its work activities. These companies are usually located in foreign countries with lower labour costs and a less strict regulatory environment.

- Companies hire regular services from external sources mostly from other countries. The services are mainly backend computers related such as BPOs, KPOs.

- Outsourcing has intensified in recent times because of the advent of Information and Communication Technologies (ITC).

- The low wage rates and availability of English-speaking skilled manpower in India have made it a destination for global outsourcing in the post-reform period of India.

Advantages of Globalisation

- Globalisation has increased the competition in various sectors of the economy which has resulted in increased productivity of domestic industries (partially true in our country)

- Globalisation has improved quality and lowered the prices for various products.

- Globalisation has offered wider choices to consumers.

- The standard of living has become higher in the era of globalization due to an increase in income and opportunities for a larger section of people in the society.

- Globalisation attracts the entry of foreign capital along with foreign updated technology which improves the quality of production.

- Globalisation has led to the immense proliferation of IT industry.

- Globalisation has benefited local companies supplying raw materials to big industries. It has resulted in the growth of Indian industries from local to global, some of which have become big MNCs.

- There is substantial improvement in FPI and FDI. In 1990-91 both FPI and FDI put together was just 100 million dollars. During 2015-16, the FDI flows alone are around 40 billion dollars.

- Foreign exchange reserves in 1990-91 came down to almost half a billion dollars and at present, they are 373 billion dollars.

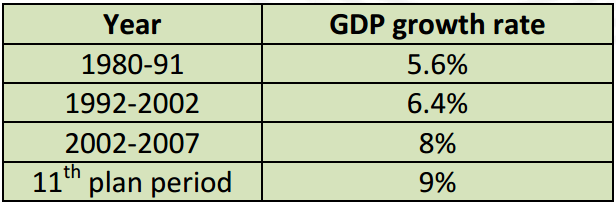

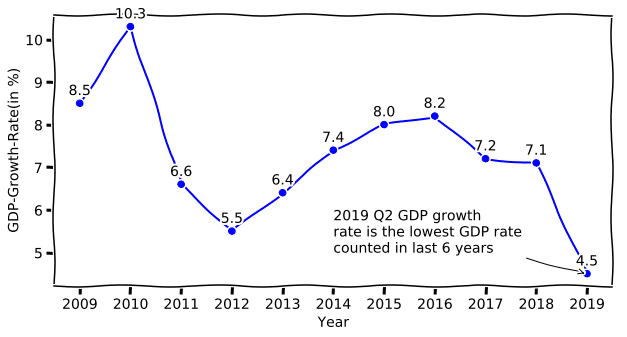

- GDP growth rate prior to 1980 was known as the Hindu rate of growth and was around 3%. But, after liberalization it grew drastically as shown in the table below:

- Most of the GDP growth is mainly due to the growth in the service sector.

- Because of globalization, Indian companies made footprints abroad like TATAs acquisition of Tetley, Corus, and NatSteel as well as acquisitions by companies like VSNL.

Disadvantages of Globalisation

- Globalisation made disparity between rural and urban Indian joblessness, growth of slum capitals and threat of terrorist activities. Well-off sections in urban areas are mostly benefitted.

- Globalization increased competition in the Indian market between foreign companies and domestic companies. Some small producers were decimated due to global competition. Several industries like the manufacturing of batteries, plastic toys, tyres, MSMEs, etc were shut down, which led to joblessness.

- More employment is being created a flexible/temporary basis due to competition/ uncertainty.

- Indian manufacturing sector as a whole suffered but the services sector benefitted.

- Domestic industries also suffered due to subsidies provided to local industries in some countries.

- Reform led growth has not created sufficient employment and though growth is substantial, employment generation has not been in commensuration with growth.

- Public investment in the agriculture sector mainly especially in infrastructure like irrigation, power, roads, market linkages, R&D was reduced in the reform period and this was the biggest drawback of economic reforms.

- Because of global competition, certain MSMEs were completely eliminated. The classic example is Toys.

- Because of the reform in the power sector, there was a steep hike in power tariff and it impacted certain section of society. E.g. suicide of Sircilia power looms.

- Small and marginal farmers have been affected adversely due to which there has been increasing incidence of suicides of cotton farmers in the Deccan part of country.

- Industrial sector also suffered because products that were manufactured in India were not world class and cheaper imports replaced the demand for domestic goods.

- Due to globalization only few sectors attracted investment and infrastructure still remained inadequate across the country.

- Protectionist policies adopted by developed countries have not resulted in level playing field and affected the export income of developing countries like India.

- Because of the reduction in tariff and because of the pressure from multilateral lending institutions, overall there is the negative impact on development and welfare expenditure.

Really very helpful. Thanks for all ur efforts.

Thank a lot Sir

Extremely helpful, Thanks!

Substantial sale and Privatisation both terms are same??

Substantial sale means transferring of assets not less than 25% and rest you know