- Sugar can be manufactured from sugarcane, sugarbeet, or any other sugar-producing crop.

- Sugarcane, on the other hand, is the primary source of sugar in India. This is the second-largest agricultural industry in the world, behind the cotton textile sector.

- In 1840, the first sugar industry in India was set up in Betia (Bihar).

- India has emerged as the largest producer and consumer of sugar in the world and the second largest exporter.

- During the sugar season in India, over 5,000 lakh metric tons (LMT) of sugarcane was produced out of which about 3,574 LMT was crushed by Sugar Mills to produce about 349 LMT of Sugar.

- 35 LMT of Sugar is diverted to ethanol production and 359 LMT of sugar was produced in sugar mills.

- There is a total capital investment of Rs. 1,250 crore in this business, which employs 2.86 lakh people. Furthermore, this business benefits 2.50 million sugarcane growers.

- Sugarcane is a heavy, low-value, weight-losing, and perishable raw material used in India’s sugar industry.

- Sugarcane cannot be preserved indefinitely due to the loss of sucrose content. Furthermore, it cannot be transported over great distances since any rise in transportation costs would increase production costs, and the sugarcane might dry out along the way.

- It is estimated that 50 per cent cost of production is accounted for by sugarcane alone. Normally , it requires about 100 tonnes of sugarcane to produce 10-12 tonnes of sugar.

- Therefore, the sugar industry is established in areas of sugarcane cultivation.

Sugar Industry: Historical Background

- India has a long tradition of manufacturing sugar.

- References of sugar making by the Indians are found even in the Atharva Veda.

- India is rightly called the homeland of sugar. But in ancient times, gur and khandsari were made.

- Also, Cane was cut in pieces – crushed under heavy weight – juice thus obtained was boiled and stirred, till it turned solids.

- Solids of uneven shape and size were called sarkaran, a Sanskrit term of ‘gravel’.

- Modern word ‘sugar’ is derived from the word Sarkara.

- Thus, India has been the original home for sugarcane as well as sugar manufacture.

- Modem sugar industry came on the Indian scene only in the middle of the 19th century, when it was introduced by the Dutch in North Bihar in about 1840. Unfortunately , this attempt could not succeed.

- The first successful attempt was made by the indigo planters at the initiative of Britishers in 1903 when Vacuum pan mills were started at Pursa, Pratabpur, Barachakia and Marhowrah and Rose in north-eastern U.P. and the adjoining Bihar. This happened when demand for indigo ceased to exist due to the introduction of synthetic blue in the market.

- In the early years of the 20th century, the industry grew rather sluggishly and there were only 18 mills in 1920-21 and 29 mills in 1930-31. The industry got a great fillip after the fiscal protection in 1931 and the number of mills rose to 137 in 1936-37.

- The production also shot up from 1.58 lakh tonnes to 9.19 lakh tonnes during the same period. The industry passed through an uncertain phase during and after the World War II and some stability was experienced only after 1950-51. There were 139 mills producing 11.34 lakh tonnes of sugar in 1950-51.

- After that, the plan period started and the industry made rapid strides. In the year 1994-95, there were 420 mills producing 148 lakh tonnes of sugar.

Sugar Industry – Legislations & Government Initiatives

- Legislations:

- “Sugar Industry Protection Act” was passed by the Indian Legislature in 1932.

- Under this act, protection was granted to the indigenous sugar industry.

- With enforcement of Sugar Protection Act, within a period of four years country became self-sufficient in sugar by 1935.

- Government Initiatives:

- The sugar sector experienced a watershed year in 2013-14.

- The Central Government accepted the suggestions of the sugar deregulation committee led by Dr. C. Rangarajan and decided to terminate the system of mill levy requirements for sugar produced after September 2012, as well as the regulated release mechanism on open market sugar sales.

- The sugar industry was deregulated in order to improve the financial health of sugar mills, increase cash flow, minimise inventory costs, and ensure that sugarcane growers were paid on schedule.

- The Committee’s recommendations on Minimum Distance Criteria and the adoption of the Cane Price Formula have been delegated to state governments for acceptance and implementation as they see fit.

- The Union Government has agreed to enhance the Minimum Selling Price (MSP) of Sugar from Rs. 29 to Rs. 31 for the 2019-20 fiscal year in order to aid Sugar farmers and to discharge their arrears/cane dues.

- Aside from that, the government has created incentives for the production of ethanol from B-heavy molasses and cane juice in order to redirect sugar surpluses to biofuel production, so indirectly increasing sugar prices.

- The new Biofuel Policy of 2018 has set a target of mixing 20% ethanol with gasoline by 2030.

Biofuel Policy of 2018

- Sugarcane juice, sugar-containing materials like Sugar Beet, starch-containing materials like Cassava, damaged food grains like broken rice, and rotting potatoes that are unsuitable for human consumption are now allowed to be utilised as raw materials for ethanol manufacturing.

- The policy permits surplus food grains to be utilised in the manufacturing of ethanol that may be blended with gasoline.

- This is to ensure that during the surplus production phase, farmers receive a fair price for their crops.

- In addition to increased tax advantages and a higher purchase price than 1G biofuels, the policy specifies a viability gap finance plan for 2G ethanol Bio refineries of Rs.5000 crore over 6 years. Advanced Biofuels are emphasised in the policy.

- The Policy encourages the establishment of supply chain mechanisms for biodiesel generation from non-edible oilseeds, spent cooking oil, and short-gestation crops.

- To promote synergy in the efforts, the Policy outlines all of the tasks and responsibilities of the involved Departments/Ministries with regard to biofuels.

Rangarajan Committee report

- The Rangarajan Committee was established in 2012 to provide suggestions on sugar sector regulation.

- Its main proposals are to abolish quantitative limitations on sugar export and import and replace them with suitable tariffs.

- There should be no more outright prohibitions on sugar exports, according to the committee.

- The central government has mandated a minimum radial distance of 15 kilometres between any two sugar mills; this condition frequently results in a virtual monopoly over a vast area, giving mills disproportionate control over farmers. The Committee suggested that the distance standard be re-examined.

- The selling of by-products should be unrestricted, and pricing should be established by the market.

- States should also alter their policies to allow mills to use bagasse-generated energy.

- Remove the restrictions on the distribution of non-levy sugar. The sugar mills’ financial health will improve if these regulations are removed.

- As a result, farmers will get timely payments and cane arrears will be reduced.

- The Commission for Agricultural Costs and Prices (CACP) advocated a hybrid approach to sugarcane price fixing based on the findings, which included a fair and remunerative price (FRP).

Fair and Remunerative Price (FRP)

- The minimal price that sugar mills must pay to farmers is known as the FRP.

- It is set based on the Commission on Agricultural Costs and Prices (CACP) recommendations and after consultation with state governments and other stakeholders.

- Farmers in Uttar Pradesh, Punjab, Haryana, Tamil Nadu, and Uttarakhand get the State Advised Price (SAP), which is normally higher than the FRP, set by state governments.

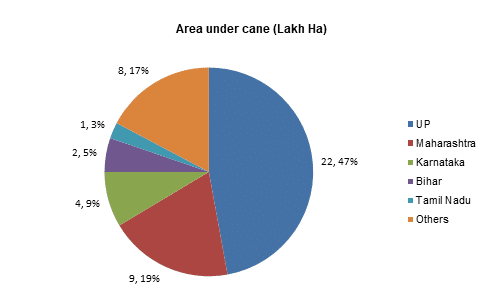

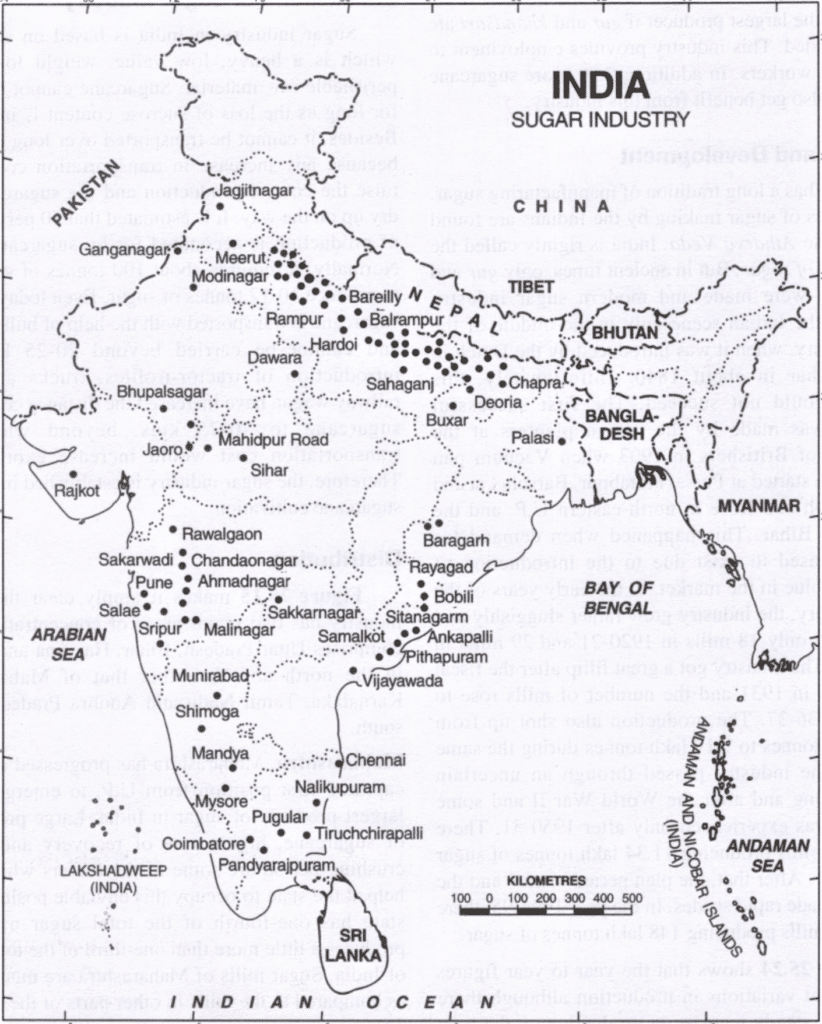

Geographical Distribution of Sugar Industry in India

Uttar Pradesh

- Uttar Pradesh is the traditional producer of sugar and has been occupying the first rank among the major sugar producing states of India.

- There are two distinct regions of sugar production in this state. One region consists of Gorakhpur, Deoria, Basti and Gonda in eastern Uttar Pradesh and the other lies in the upper Ganga Plain consisting of Meerut, Saharanpur, Muzaffarnagar, Bijnore and Moradabad.

- Uttar Pradesh is the largest cultivator of sugarcane in India. With more than 177 million tonnes produced in 2021, UP tops the list of sugarcane producers. The main reason behind this is the perennial water supply provided by the river Ganga.

- Meerut, Bareilly, Saharanpur, and Bulandshahr are the major districts producing sugarcane in UP.

Maharashtra

- Maharashtra ranks second in the list of largest sugarcane producing state in India.

- Large production of sugarcane, higher rate of recovery and longer crushing period are some of the factors which have helped the state to occupy this enviable position.

- The state has one-fourth of the total sugar mills and produces a little more than one-fifth of the total sugar of India. Sugar mills of Maharashtra are much larger as compared to the mills in other parts of the country.

- The major concentration of sugar mills is found in the river valleys in the western part of the Maharashtra Plateau. Ahmednagar is the largest centre. The other major centres are in the districts of Kolhapur, Solapur, Satara, Pune and Nashik.

- For 2021-22, the area reserved for sugarcane plantation was increased to 12.32 lakh hectares. Consequentially, the per hectare production of sugarcane is expected to be 97 tonnes.

- Pune, Satara, Solapur, Ahmednagar, and Aurangabad are the major producers.

Karnataka

- Karnataka is the third-largest producer of sugarcane in India. The climatic condition here favors the production of top-quality sugarcane.

- Belgaum and Mandya districts have the highest concentration of sugar mills. Bijapur, Bellary, Shimoga and Chittradurga are the other districts where sugar mills are scattered.

- It recorded production of over 38 MT in 2019-20.

- Districts such as Shimoga, Mysore, Belgaum, and Chitradurga are the largest producers, thanks to the irrigation projects in the Cauvery River.

Tamil Nadu

- Tamil Nadu has shown phenomenal progress with regard to sugar production during the last few years. High yield per hectare of sugarcane, higher sucrose content, high recovery rate and long crushing season have enabled Tamil Nadu to obtain highest yield of sugar per hectare in the whole of India.

- Tamil Nadu occupies the fourth position in list of major producer of sugarcane in India. The state produces an average of 18.5 MT of sugarcane annually.

- However, it tops the list in terms of productivity per hectare. It produces an average of 99 tonnes/ha.

- Most of the mills of the state are located in Coimbatore, Tiruppur, Karur and Tiruchchirapalli.

Bihar

- Bihar was the second largest sugar producing state next only to Uttar Pradesh till mid- 1960s. Since then the state has been experiencing sluggish growth and consequently lost its prestigious position to the peninsular states like Maharashtra, Tamil Nadu , Karnataka and Andhra Pradesh.

- Bihar is one of the top producers of sugarcane and jaggery, thanks to its fertile plains.

- The belt of eastern Uttar Pradesh extends further east in Bihar and the districts of Darbhanga, Saran, Champaran and Muzaffarpur are included in this belt. The major contributors are Patna, Darbhanga, Gaya, and Champaran districts.

Gujarat

- Gujarat’s mills are scattered in Surat, Bhavnagar, Amreli, Banaskantha, Junagarh, Rajkot and Jamnagar districts.

- Despite being an industrial area, Gujarat contributes more than 3% of the total sugarcane produced in the country.

- The bulk contribution comes from its southern districts like Valsad, Navsari, Surat, and Bharuch.

Haryana

- Haryana is one of the largest contributors to India’s central pool of food grains. Apart from sugarcane, Haryana also produces large quantities of rice, jawar, bajra, and maize.

- It produces more than 8MT of sugarcane in 1.3 lac hectares of land.

- Sugar mills are located in Rohtak, Ambala, Panipat, Sonipat, Karnal, Palwal and Hisar districts.

Andhra Pradesh

- The black alluvial soil of Andhra Pradesh is perfect for sugarcane cultivation. The districts around Krishna and Godavari benefit from these rivers and can produce sugarcane in bulk quantities.

- Majority of the sugar mills are concentrated in East Godawari West Godavari, Krishna, Vishakhapatnam, and Chittoor districts.

Telanagana

- Most of the sugar mills are concentrated in Nizamabad and Medak districts.

Punjab

- Punjab occupies the ninth position on this list. On average, it produces 7 MT of sugarcane in 0.92 lac hectares of land.

- The high productivity is due to the inbuilt agricultural culture in the state.

- Punjab’s mills are located in Amritsar, Jalandhar, Gurdaspur, Sangrur, Patiala and Rupnagar districts.

Uttarakhand

- The hilly state of Uttarakhand ranks 10th on the list, with an average annual production of 6.38 MT.

- Dehradun, Haridwar, and Udham Singh Nagar are major contributors to this high number.

North India vs. South India Sugar Industry

A brief description of differences between the sugar industry of the northern and peninsular India is given below:

- Peninsular India has tropical climate which gives higher yield per unit area as compared to north India.

- The sucrose content is also higher in tropical variety of sugarcane in the south.

- The crushing season is also much longer in the south than in the north.

- For example, crushing season is of nearly four months only in the north from November to February, whereas it is of nearly 7-8 months in the south where it starts in October and continues till May and June.

- The co-operative sugar mills are better managed in the south than in the north.

- Most of the mills in the south are new which are equipped with modern machinery.

Problems of Sugar Industry:

Sugar industry in India is plagued with several serious and complicated problems which call for immediate attention and rational solutions. Some of the burning problems are briefly described as under:

- Low Yield of Sugarcane

- Although India has the largest area under sugarcane cultivation, the yield per hectare is extremely low as compared to some of the major sugarcane producing countries of the world.

- For example, India’s yield is only 64.5 tones/hectare as compared to 90 tonnes in Java and 121 tonnes in Hawaii.

- This leads to low overall production compared to capacity or potential.

- Short crushing season

- Manufacturing of sugar is a seasonal phenomenon with a short crushing season varying normally from 4 to 7 months in a year.

- The mills and its workers remain idle during the remaining period of the year, thus creating financial problems for the industry as a whole.

- Fluctuating Production Trends

- Sugarcane has to compete with several other food and cash crops like cotton, oil seeds, rice, etc.

- Consequently, the land available to sugarcane cultivation is not the same and the total production of sugarcane fluctuates.

- This affects the supply of sugarcane to the mills and the production of sugar also varies from year to year.

- Low rate of recovery

- The average rate of recovery in India is less than ten per cent which is quite low as compared to other major sugar producing countries.

- For example recovery rate is as high as 14-16 per cent in Java, Hawaii and Australia.

- High cost of Production

- High cost of sugarcane, inefficient technology, uneconomic process of production and heavy excise duty result in high cost of manufacturing.

- The production cost of sugar in India is one of the highest in the world.

- Small and uneconomic size of mills

- Most of the sugar mills in India are of small size with a capacity of 1,000 to 1,500 tonnes per day.

- This makes large scale production uneconomic. Many of the mills are economically not viable.

- Old and obsolete machinery

- Most of the machinery used in Indian sugar mills, particularly those of Uttar Pradesh and Bihar is old and obsolete, being 50-60 years old and needs rehabilitation.

- But low margin of profit prevents several mill owners from replacing the old machinery by the new one.

- Competition with Khandsari and Gur

- Khandsari and gur have been manufactured in rural India much before the advent of sugar industry in the organised sector.

- Since khandsari industry is free from excise duty, it can offer higher prices of cane to the cane growers.

- Further, cane growers themselves use cane for manufacturing gur and save on labour cost which is not possible in sugar industry.

- It is estimated that about 60 per cent of the cane grown in India is used for making khandsari and gur and the organised sugar industry is deprived of sufficient supply of this basic raw material.

- Regional imbalances in distribution

- Over half of sugar mills are located in Maharashtra and Uttar Pradesh and about 60 per cent of the production comes from these two states.

- On the other hand, there are several states in the north-east, Jammu and Kashmir and Orissa where there is no appreciable growth of this industry. This leads to regional imbalances which have their own implications.

- Low per capita consumption

- The per capita annual consumption of sugar in India is only 3 kg as against 48.8 kg in the USA., 53.6 kg in U.K., 57.1 kg in Australia and 78.2 kg in Cuba.

- The world average of about 21.1 kg. This result in low market demand and creates problems of sale of sugar.

- FRP vs SAP

- The central government declares a min price of sugarcane that called Fair Remunerative Price (FRP) and state

- Governments have also right to declare their own price which is called State Advisory Price (SAP).

- Generally SAP is more than FRP which pose the conflict that which is fair price for both farmers and mills.

- Falling Sugar Prices

- According to the Indian Sugar Mills Association, the FRP of sugarcane rose 50.9% from Rs 139.12 per quintal in 2010-11 to Rs 210 per quintal in 2013-14.

- However, sugar prices fell 21% from Rs 3,765 per quintal in January 2010 to Rs 2,962 per quintal in August 2014.

- Lower margins have made companies heavily dependent on debt.

- Min Distance Criterion

- To ensure decent supply of sugarcane to each sugar mill, the central government has prescribed a minimum radial distance of 15 km between any two sugar mills.

- But this criterion help to create the monopoly of mill owner over a large area as 15 km radial distance is large in number and ultimately led to exploitation of farmers especially where landholding is smaller.

- Also this regulation prohibits innovation and investment by entrepreneurs.

- Unpaid dues to Farmers

- India’s sugarcane dues accruing to farmers have remained stubbornly high despite. The sugarcane growers are being exploited by not paying their due arrears.

- For instance, in Uttar Pradesh, sugarcane farmers have not been paid for 20200. Further they get ‘zero price’ receipts for 2021.

- High Export prices

- Exporting the surplus from India is not easy because of the burden of very high cost of sugarcane, pushing up the costs of sugar.

- For a comparison, Indian cane prices are 70-80% higher than that in Brazil.

Measures to resolve the issues

Implementing Rangarajan Committee Recommendations:

- Removing Distance Norm: In order to increase competition and ensure a better price for farmers, the Committee recommended that the distance norm be reviewed. Removing the regulation will ensure better prices for farmers and force existing mills to pay them the cane price.

- Reviewing Revenue Sharing Policy: States should not declare their own SAP. The pricing shall be done on basis of scientific and economically viable principles. The committee suggested that sharing of revenue generated under sugarcane supply chain shall be divided on basis of 70:30 to farmers and mill owners respectively. This method will be applicable for by products as well. The payment shall be paid to farmers in two installments:

- First Floor or FRP should be paid to farmers at time of purchase of sugarcane,

- Second, balance should be paid after final price of sugar decided and sold by mill.

- Duties: Import and export duty should not be more than 10%.

- Long term agreements: States should encourage development of market-based long-term contractual arrangements, and phase out cane reservation area.

- Exports and Byproducts: No more outright bans on sugar exports. No restrictions on sale of by-products and prices should be market determined.

Other suggestions

- Price Rationalization: Cane-pricing policies need immediate rationalization and brought in tune with global practices, for Indian sugar industry to export the surplus successfully.

- Ethanol Blending: The new national policy on Biofuels 2018, expands the scope of raw material for ethanol production by allowing use of Sugarcane Juice. Ethanol production should be promoted. Such diversion will cut oil import bills and bring profits for sugar industry. A win–win situation. Brazil, the world’s biggest sugarcane producer, depends on ethanol, and not sugar, as the main revenue source from sugarcane and blends 27 per cent ethanol with petrol.

- The new Biofuel Policy 2018 has fixed a target of achieving 20 per cent ethanol blending with petrol by 2030.

- R&D: Intense Researches should be funded for developing high yielding, early maturing, frost resistant and high sucrose content varieties of sugarcane.

- Crushing Season: Increase the crushing season by sowing and harvesting sugarcane at proper intervals in different areas adjoining the sugar mill. This will increase the duration of supply of sugarcane to sugar mills.

- Yield: Intense research is required to increase the sugarcane production in the agricultural field.

- Production Cost: Production cost can be reduced through proper utilisation of by-products of the industry.

- For example, bagasse can be used for manufacturing paper pulp, insulating board, plastic, carbon cortex etc. Molasses comprise another important by-product which can be gainfully used for the manufacture of power alcohol.

- Technology: There is a dire need of Technological upgradation in age old mills to improve efficiency in production.

- Export promotion: Tweaking of policies to boost exports when Domestic consumption is less than production.

- Diversification: Mills should be incentivized to produce more alcohol and its export should be deregulated. This will improve the economic situation of the mills.

- SSI: More steps like Sustainable Sugarcane Initiative. SSI provides practical options to farmers for improving the productivity of their land, water and labour, all at the same time. SSI is a set of practices based on principles for producing ‘More with Less’ in agriculture. Example: Reducing overall pressure on water resources — Highly relevant for water guzzling Sugarcane crop.