- The Pradhan Mantri Fasal Bima Yojana (PMFBY) launched on 18 February 2016 by Prime Minister Narendra Modi is an insurance service for farmers for their yields.

- It was formulated in line with the One Nation–One Scheme theme by replacing the earlier two schemes National Agricultural Insurance Scheme (NAIS) and Modified National Agricultural Insurance Scheme (MNAIS) by incorporating their best features and removing their inherent drawbacks (shortcomings).

- The scheme is being administered by the Ministry of Agriculture and Farmers Welfare.

- It aims to reduce the premium burden on farmers and ensure early settlement of crop assurance claims for the full insured sum.

- PMFBY aims to provide a comprehensive insurance cover against failure of the crop thus helping in stabilising the income of the farmers.

- The Scheme covers all Food & Oilseeds crops and Annual Commercial/Horticultural Crops for which past yield data is available and for which requisite number of Crop Cutting Experiments (CCEs) are being conducted under General Crop Estimation Survey (GCES).

- The scheme is implemented by empanelled general insurance companies. Selection of Implementing Agency (IA) is done by the concerned State Government through bidding.

- The scheme was earlier compulsory for loanee farmers availing Crop Loan /KCC account for notified crops and voluntary for other others but has been made voluntary since 2020 when reforms in the scheme were introduced.

- Eligibility: Farmers including sharecroppers and tenant farmers growing notified crops in the notified areas are eligible for coverage.

- Premium:

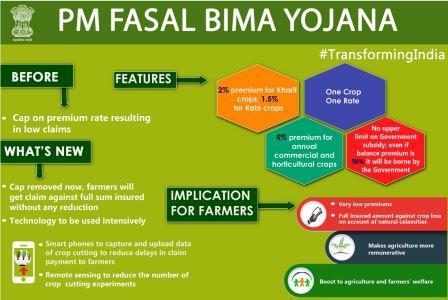

- There will be a uniform premium of only 2% to be paid by farmers for all Kharif crops and 1.5% for all Rabi crops.

- In the case of annual commercial and horticultural crops, the premium to be paid by farmers will be only 5%.

- The premium rates to be paid by farmers are very low and the balance premium will be paid by the Government to provide full insured amount to the farmers against crop loss on account of natural calamities.

- There is no upper limit on Government subsidies. Even if the balance premium is 90%, it will be borne by the Government.

- Earlier, there was a provision of capping the premium rate which resulted in low claims being paid to farmers.

- This capping was done to limit Government’s outgo on the premium subsidy.

- This capping has now been removed and farmers will get a claim against the full sum insured without any reduction.

- Use of Technology:

- Crop Insurance App:

- Provides for easy enrollment of farmers.

- Facilitate easier reporting of crop loss within 72 hours of occurrence of any event.

- Latest Technological Tools: To assess crop losses, satellite imagery, remote-sensing technology, drones, artificial intelligence and machine learning are used.

- PMFBY Portal: For integration of land records.

- Crop Insurance App:

- Recent Changes:

- The scheme was once mandatory for loanee farmers, but in 2020, the Centre changed it to make it optional for all farmers.

- Earlier the rate of average premium subsidy including the difference between the actuarial premium rate and the rate of the insurance premium payable by the farmer was shared by the state and center, further states and UTs were free to extend additional subsidies over and above the average subsidy from their budgets.

- The Centre decided in February 2020 to limit its premium subsidy to 30% for unirrigated areas and 25% for irrigated ones (from the existing unlimited). Previously, the central subsidy had no upper limit.

- For north-eastern states, the centre’s share in premium subsidy to be increased to 90% from 50% earlier.

- Information, Communication and Education (ICE) Activities – 0.5% of the total premium collected by the insurance companies to be spent on ICE activities.

- Those districts that will have an area under irrigation for more than 50% will be considered as an irrigated districts.

- Penalty on states:If a state delays to release requisite premium subsidy to insurance companies beyond a set time limit (March 31 – For Kharif Season; September 30 – For Rabi Season), states will not be allowed to run the scheme in subsequent seasons.

- To conduct Crop Cutting Experiments (CCEs), there will be the adoption of technology solutions including the Smart Sampling Technique (SST).

- The scheme was once mandatory for loanee farmers, but in 2020, the Centre changed it to make it optional for all farmers.

What is covered under PMFBY?

The Pradhan Mantri Fasal Bima Yojana will cover the following cases under crop insurance:

- Local natural calamities like landslides, hailstorms, etc.

- Calamities leading to loss of yield like floods, dry spells, droughts, etc. Pest infestation that causes yield loss is also covered by PMFBY.

- Losses that occurred after harvesting crops can also be covered under this scheme. These circumstances may befall due to cyclones, unseasonal rains, cyclonic rains, etc.

- Nevertheless, PMFBY does not provide any safety against the following circumstances:

- Losses occurred due to war or similar hazardous activities.

- Loss of yield due to the act of enmity or riots.

- Yield destruction caused by domestic and/or wild animals

- Contamination due to nuclear risks.

- Malicious damage leads to yield carnage.

- It is proposed by the scheme to use remote sensing technology, smartphones, or drones to expedite crop loss estimation.

Issues Related to the PMFBY Scheme

- Financial Constraints of States: The financial constraints of the state governments and low claim ratio during normal seasons are the major reasons for the non-implementation of the Scheme by these States.

- States are unable to deal with a situation where insurance companies compensate farmers less than the premium they have collected from them and the Centre.

- The State governments failed to release funds on time leading to delays in releasing insurance compensation.

- This defeats the very purpose of the scheme which is to provide timely financial assistance to the farming community.

- Claim Settlement Issues: Many farmers are dissatisfied with both the level of compensation and delays in settlement.

- The role and power of Insurance companies is significant. In many cases, it didn’t investigate losses due to a localised calamity and, therefore, did not pay the claims.

- Implementation Issues: Insurance companies have shown no interest in bidding for clusters that are prone to crop loss.

- Further, it is in the nature of the insurance business for entities to make money when crop failures are low and vice-versa.

Way Forward

- There is a need for comprehensive rethinking among states and the central governments to further resolve all the pending issues around the scheme so that the farmers could get benefit from this scheme.

- Further, rather than paying subsidies under this scheme, the state government should invest that money in a new insurance model.