Money laundering is the process of disguising the money of criminal origin and making it look like legit money after bringing it into the legitimate financial system. It is problematic for criminals to use the illicit money because they cannot explain it to legal authorities where it came from and it is also easier to trace them back to the crime. But after it is laundered, it becomes difficult to distinguish it from legit money and hence funds can be easily used by criminals without detection.

The United Nations Office on Drugs and Crime (UNODC) conducted a study to determine the magnitude of illicit funds generated by drug trafficking and organised crimes and to investigate to what extent these funds are laundered. The report estimates that in 2009, criminal proceeds amounted to 3.6% of global GDP, with 2.7% (or USD 1.6 trillion) of it being laundered.

This falls within the widely quoted estimate by the International Monetary Fund, which stated in 1998 that the aggregate size of money laundering in the world could be somewhere between two and five percent of the world ’s gross domestic product. Using 1998 statistics, these percentages would indicate that money laundering ranged between USD 590 billion and USD 1.5 trillion. At the time, the lower figure was roughly equivalent to the value of the total output of an economy of the size of Spain.

However, the above estimates should be treated with caution. They are intended to give a rough estimate of the magnitude of money laundering. Due to the illegal nature of the transactions, precise statistics are not available and it is therefore impossible to produce a definitive estimate of the amount of money that is globally laundered every year.

Common Sources of Illegal Money

- Trafficking of drug, arms and human beings

- Terrorism

- Tax evasion

- Organised Crime like kidnapping, contract killing, gambling, prostitution, bank frauds etc.

- Money paid to gangsters/ criminals for safety of business (protection money)

- Money earned through adulterated products, corruption etc.

- Slush funds or Black funds – Secret reserve of money by Corporates for bribery to politicians or donation to political parties

- Capitation fee – illegal fees sought by educational institutions

- Money lenders who charge extremely high interest also called as loan sharks

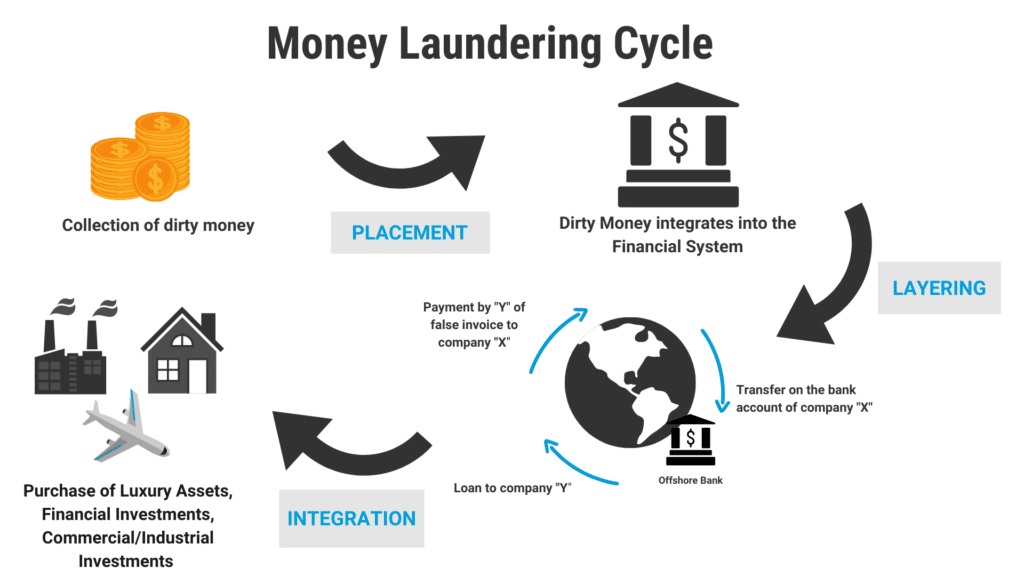

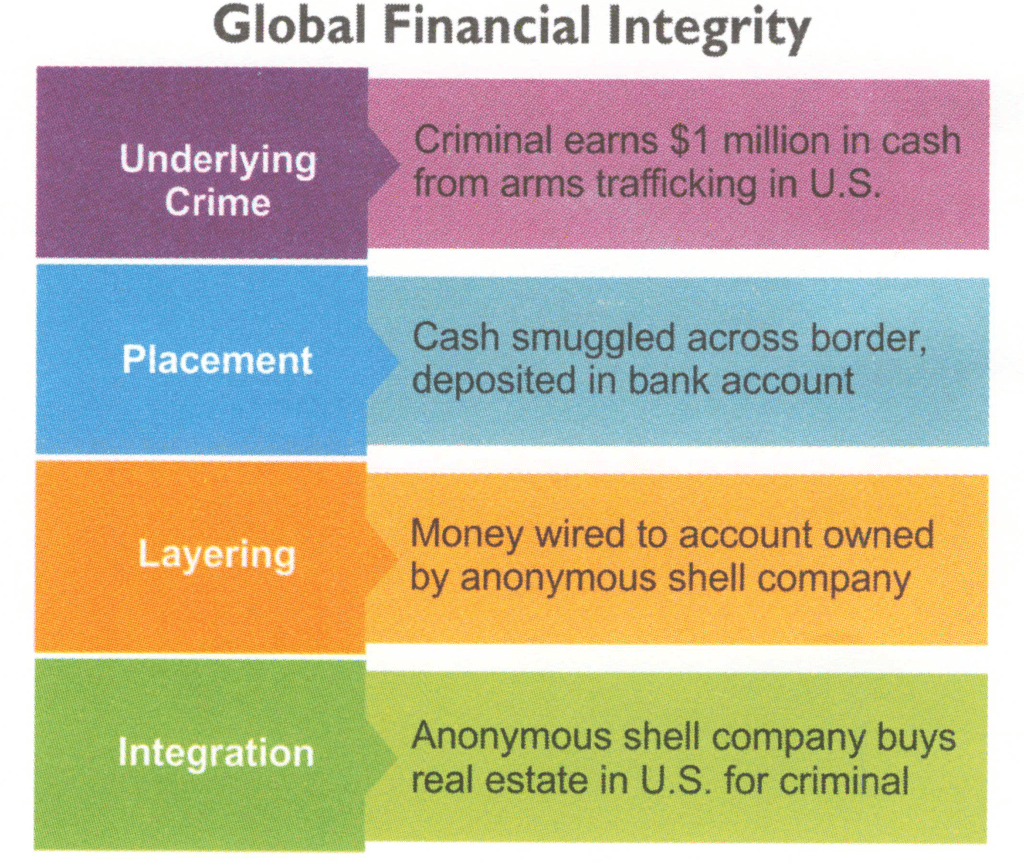

Process of Money Laundering

There are numerous techniques to launder money. However, money laundering can be broken down into three stages:

Step 1: Placement: Illegal money is deposited into the Financial Institutions using different methods. The main aim of this step is to remove the proceeds of crime (illegal money) from the criminal place to avoid detection by legal authorities. Methods or techniques involved in first phase with Financial Institution:

- Structuring/Smurfing technique: This technique is very simple just deposit the large amount of illegal money into small amounts of cash in the accounts of unconnected depositors below the reporting threshold limit set by authorities. The person who is involved in the technique is called smurf.

- Using connected accounts: Accounts of relatives, benamis, associates such as shell companies (Fake Companies).

- Multiple legitimate accounts of same person in different banks and misusing the accounts of the Educational Institutions, Non Profit Organisations, Charity trusts etc.

Step 2: Layering: Untying the illicit or criminal origin of the illegal money through a complex web of financial transactions. The main objective of this phase is to make the source of fund and its ownership untraceable, through multiple layering of a complex network of transactions. Methods or techniques involved in layering phase with Financial Institution:

- Remittance Services like Foreign Telegraphic Transfers,

- Bank drafts/money orders,

- Loans to Shell companies and Front Companies

Step 3: Integration: In this step main objective is to paint a legitimate image for illegal money. This is the last stage of the laundering process. After using the above methods of laundering, the illegal money is now circulated into the economy by way of investments, purchase of lands, expenditure or savings.

Techniques of Money Laundering

Deposit Structuring/Smurfing

- This procedure involves making a large number of deposits of little amount below the reporting limit set by authorities, either by countless detached investors or to an extensive number of accounts.

Cash Deposits followed by Telegraphic Transfer

- Large cash deposits might be made by drug traffickers or other people who have smuggled criminal property out of the nation where the wrong doing took place. Frequently the cash deposit is immediately followed by a telegraphic transfer to another person (which could be in the first nation where the wrong doing was detected), in this way bringing down the danger of seizure.

Connected Accounts

- Probably it is troublesome for criminals to open accounts in false names as relevant recognizable proof is necessary to open a bank account. So as the case maybe that accounts may be held in the names of relatives, partners or different persons working for the benefit of the criminal.

Trade Based Money Laundering

- This method simply relies on under or over valuation of invoices to conceal flow of money and making the dirty money coming from legit source of income. These type of laundering techniques is widely used in Gold and Diamond market.

- Gold: Gold has intrinsic value and a constant market. Country like India which are exporting way more gold than its production generates ample opportunities for laundering activities using gold. Example: Drug trafficking agent pays in the form of gold and then this gold is imported with false invoice.

- Diamond: The illegal trade of diamonds is an important source for launders and terrorists. Unlike gold which is homogeneous metal (if we cut gold into half , the price is also divided equally) the diamond is a non homogeneous. The value of diamond is very complex even if both the diamonds are same colour, weight and clarity still they are not same as one might be twice the value of other and spotting the value of diamond requires lots of skill. This nature of diamonds helps the launders to easily manipulate the value of diamonds in the invoice. Also, terrorist use illegal trade of diamonds as their source of funds transaction.

Round Tripping through Tax Havens

- Tax Havens are countries with a very low or no tax liability along with minimal paper work. The money is deposited in account of an offshore controlled enterprise and then brought back as Foreign Direct Investment, exempting tax liabilities. Here also the dirty money is mixed and accounts are manipulated to disguise its criminal source. Another variant is to transfer the fund to a law firm or other such organisation as fee charged and then to cancel the retainer. Thereafter the money is remitted as sum received from lawyer as a legacy under will or proceeds of litigation.

Shell Companies and Trusts

- They are just a paper companies/trusts. They may or may not physically exist but they won’t do any productive activities like manufacturing or trading. For example: Mr. Shayam is a money lender, he lends money with a heavy hefty interest rate. But he registered his company as M/s. Shayam Enterprises with sales tax registration and pays sales tax for selling of a commodity. He also files income tax for the net profit in the name of M/s. Shayam Enterprises as a trader. This is also a money laundering process since he is actually a loan shark earning income from the lending at a very high interest rate but he used this fake company to change the source of revenue as earned from a legal trading activity.

Front Organizations

- A company/non profit organization/trust which is used to shield another company from liability and scrutiny and generally used to launder illegal money. Mostly the business of these companies relates to huge cash transaction. For example: casinos, brokerage firms, Chit funds and in some countries banks.

Informal Value Transactions or Hawala

- In India and South Asia, Hawala System is a familiar type of money laundering technique. Hawalas, an Arabic word for a particular international underground banking system, is nothing but a parallel illegal banking system. One just need to Hand over cash to a hawala agent in country A and the agent will arrange it into cash (or at times gold) in country B . The hawalas provide the complete service from placement to integration.

Currency Exchange Bureaus

- They are not as heavily regulated as banks, and de facto, at least, may not be regulated at all, so they are at times used for laundering. Substantial foreign exchange transactions are said to be taking place from banks to these small enterprises. A two step process is usually applied in this laundering method. At first, the large amounts of criminal proceeds in local currency is changed into low-bulk foreign currency, preferably US dollar or Euro, for physical smuggling out of the country. In the next step the electronic funds transfer to offshore accounts is done. In a reported case, a currency bureau reportedly exchanged the equivalent of more than $50 million through a foreign bank without registering these transactions in its official records.

Bank Capture

- In this method a financial institution, such as banks, is owned or controlled by unscrupulous individuals suspected of working with drug dealers and other organised crime groups. This makes the process very easy for launderers. They could easily manipulate the records and conceal the illegitimacy of the funds. The complete liberalisation of the financial sector without adequate checks have provided sufficient leeway for laundering.

Credit Card Advance Payments

- A credit card holder may make a large payment with dirty money to the issuing bank, resulting in a negative balance due. The bank then pays out the balance with a check, which can be deposited into a personal account as apparently clean money. Structured cash payments for outstanding credit card balances is the most widely recognized use of Visas for tax evasion, frequently with moderately substantial payments as installments and in some cases, with money installments from outsiders. Another method is to use loans from Visa records to buy cashier’s checks or to wire assets to outside destinations . On some events, loans are kept into investment funds or current records. A substantial number of distinguished situations include the utilization of lost or stolen cards by outsiders.

Black Salaries

- A registered company may have several unregistered employees without any written contract. Then it pays them using the illegitimate cash and manipulate the invoices to show revenue generation. Thereby bringing into system illegit cash concealing its identity. Another method applied is that paying higher salary in cheque and then taking back the amount in cash thereby manipulating the accounts to pay cash for some real estate purchase or hawala transfer.

Legitimate Business Transactions

- Illegitimate money can be added to the cash revenues of a legitimate business enterprise, predominantly those that are already cash intensive, such as restaurants, bars, casino, video rental stores, retail chains, shopping malls etc. The extra cash is simply added to the books. The cost for this laundering method is just the tax paid on the income. The companies whose transactions are better documented, the invoices can be easily manipulated to simulate legitimacy disguising illegal money. Take for example, a used car dealer may offer a customer a discount for paying cash, then report the original sale price on the invoice, thereby disguising the existence of the extra illicit cash. A slightly more sophisticated scheme may allow a criminal to profit twice in setting up a publicly traded front company with a legitimate commercial purpose—first by mixing laundered money with those generated by the legitimate business , and second by selling shares of this company to unwitting investors.

Bank Drafts and Similar Instruments

- Bank drafts, money orders, and cashier’s cheques purchased for cash are useful for laundering purposes because they provide an instrument drawn on a respectable bank or other credit institution and so break the money trail. Breaking this trail is of critical importance to the money launderer, as it makes it impossible – or at least very difficult – for an investigator to establish where laundered funds have ended up. This reduces the ability of the law enforcement authorities to seek a judicial order to appropriate such funds.

Remittance Services

- The remittance business receives cash , which it transfers to the banking system of another account held by an associated company in the foreign jurisdiction. There the deposited money can then be made available to the ultimate recipient The criminal organization to receive the funds in the designated country in the local currency, which is then sold to foreign business people who need currency to fund the legitimate purchase of goods and exports.

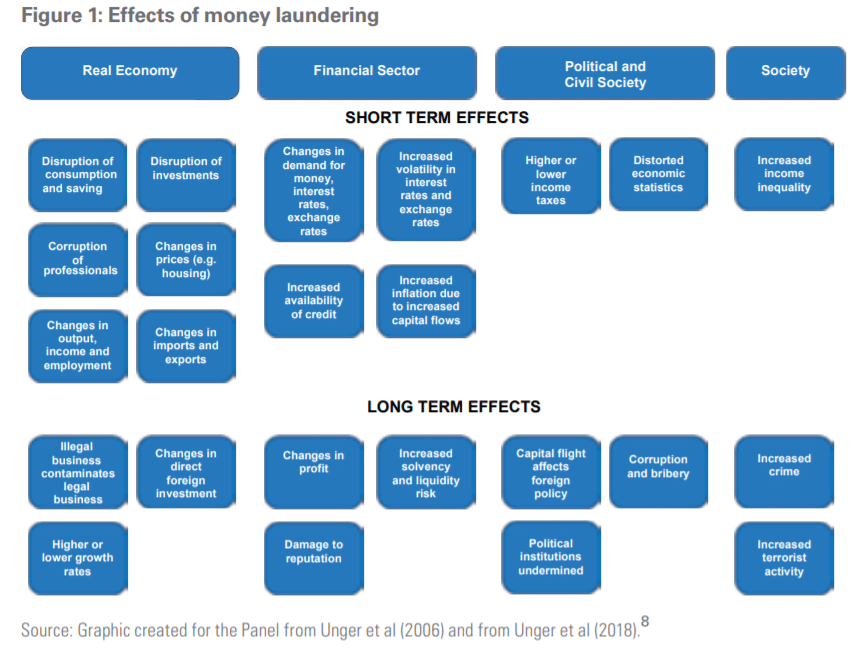

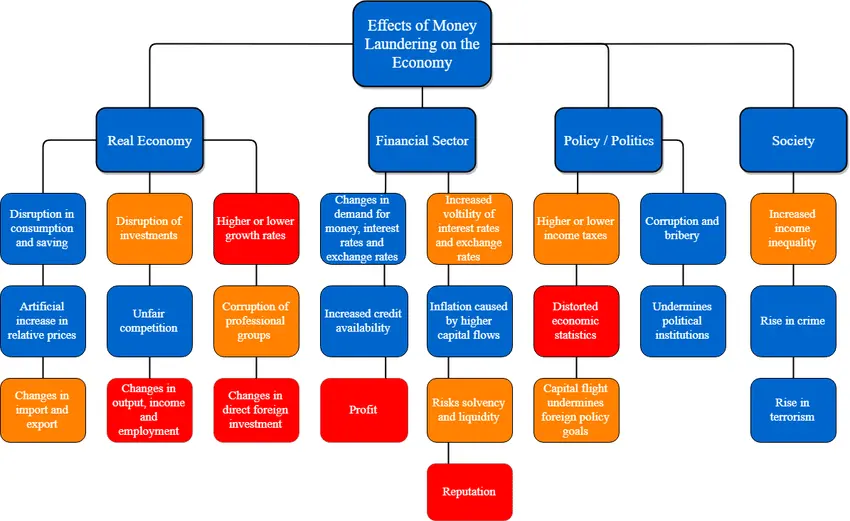

Economic Effects of Money Laundering

The major aim of a large number of criminal activities is to generate huge profits for the individual or group that carries out such activities . Money laundering disguise the criminal proceeds’ illegal origin, thereby enabling the criminals to enjoy these profits without compromising their source. Such huge amount of criminal proceeds affects all aspects of economy, starting from revenue losses to government to questioning integrity of financial market to successful functioning of free market.

Loss of Revenue

- Economies with growing or developing financial centres generally have inadequate control measures and are particularly vulnerable. They keep on exploiting the loopholes of system, enjoy all the exemptions and evade taxes, thereby causing enormous amount of loss of revenue to government. At the same time substantial resources are diverted to check such illegal activities. Thus, putting double burden on revenues.

Undermining the Legitimate Private Sector

- lllegit money being pumped into legit private sector especially, real estate, undermines the functioning of private sector by market forces without government regulation. It dampens the ethical and sound business practices as well demoralises the other business competitors who do business legally putting in legitimate money generally borrowed from bank at high interest rate.

Undermining the Integrity of Financial Markets

- The integrity of the banking and financial services marketplace depends heavily on the point of view that it functions within a set up of high legal, professional and ethical standards.

Economic Distortion and Instability

- As for the potential negative macroeconomic consequences of unchecked money laundering, one

can cite inexplicable changes in money demand, prudential risks to bank soundness, contamination effects on legal financial transactions, and increased volatility of international capital flows and exchange rates due to unanticipated cross-border asset transfers. - Also, as it rewards corruption and crime, successful money laundering damages the integrity of the entire society and undermines democracy and the rule of the law.

Social Cost of Money Laundering

- The possible social and political costs of money laundering, if left unchecked or dealt with ineffectively, are very serious. Some might argue that developing economies cannot afford to be too selective about the sources of capital they attract. But postponing an action or inaction can be very dangerous.

- The more it is deferred, the more entrenched organised crime can become. The organised crime can infiltrate financial institutions, acquire control of large sectors of the economy through investment, or offer bribes to public officials and induce government by funding electoral campaign of a political party, thereby hollowing the system from inside out. For countries transforming to democratic systems, these criminal activities can undermine the transition. Money laundering act as oxygen for criminal activity like drug trafficking and other organised crimes to continue and flourish inflicting huge social costs on societal progress and economic development of a country.

Government Measures to Prevent Money Laundering

Constitution of Multi-Agency Group (MAG) for Panama Paper Leaks

- Constitution of Multi-Agency Group (MAG) consisting of officersof CentralBoardof DirectTaxes(CBDT), Reserve Bank of India (RBI), Enforcement Directorate (ED) and Financial Intelligence Unit (FIU) for investigation of recent revelations in Panama paper leaks naming several businessmen, politician, famous personalities etc., as stakeholder in various shell companies. Such shell companies are suspected of money laundering and tax evasion.

Joining the Multilateral Competent Authority Agreement

- Proactively engaging with foreign governments with a view to facilitate and enhance the exchange of information under Double Taxation Avoidance Agreements (DTAAs)/Tax Information Exchange Agreements (TIEAs)/Multilateral Conventions.

Information Sharing Arrangement with USA under FATCA

- The Foreign Account Tax Compliance Act (FATCA) is 2010 U.S. federal law intended to detect and deter the evasion of US tax by US persons who hide money outside the US. Information sharing arrangement with USA under FATCA will facilitate automatic exchange of information in tax matters under Common Reporting Standard (CRS) which will allow tax authorities to obtain a clearer understanding of financial assets held abroad by their residents, for tax purposes.

Linking Aadhaar and PAN

- Supreme court in Aadhaar Judgement held that, Section 139AA of IT Act makes Aadhaar mandatory for filing IT returns and applying for PAN. Since it did not violate the right to privacy, linking of PAN with Aadhaar will be mandatory.

- The consequence of non-linking can lead to PAN becoming invalid. Aadhar being 12 digital unique identification number cannot be issued to a person multiple times so it will eliminate the duplicate PANs of an individual thereby improving tax compliance and help to curb Benami transaction and money laundering.

Double Tax Avoidance Agreement (DTAA)

- Renegotiation of DTAAs with other countries to bring the Article on Exchange of Information to International Standards and expanding India’s treaty network by signing new DTAAs and Tax Information Exchange Agreements (TlEAs) with many jurisdictions to facilitate the exchange of information and to bring transparency.

Initiation of ‘Project Insight’

- Initiation of the information technology based ‘Project Insight’ for strengthening the non-intrusive, information driven approach for improving tax compliance. It will also track black money accounts caught during the demonetisation period.

Launching of ‘Operation Clean Money’

- Launching of ‘Operation Clean Money’ on 31st January 2017 for collection, collation and analysis of information on cash transactions, extensive use of information technology and data analytics tools for identification of high risk cases, expeditious e-verification of suspect cases and enforcement actions in appropriate cases, which include searches, surveys, enquiries, assessment of income, levy of taxes, penalties, etc. and filing of prosecution complaints in criminal courts, wherever applicable.

Action against Shell Companies

- The government decided to bar as many as 300,000 directors of companies that have defaulted on statutory compliances from serving on the boards of other firms to improve corporate governance and check financial irregularities through the use of shell companies.

Prevention of Money Laundering (Amendment) Act, 2012

- The Prevention of Money Laundering (Amendment) Act, 2012 seeks to amend the Prevention of Money Laundering Act, 2002.

- India was working towards membership to the Financial Action Task Force (FATF), an intergovernmental body. This Bill conforms to several requirements of this body.

- Money laundering applies only to offences listed in the schedule. The Bill adds several offences to this list like concealment, acquisition, possession and use of proceeds of crime as criminal activities. It also includes a new category of offences with cross border implications.

- It also adds the concept of ‘reporting entity’ which would include a banking company, financial institution, intermediary or a person carrying on a designated business or profession.

- The Act requires banks and other specified institutions to maintain record of clients and transactions and furnish them to the prescribed authority . The Bill includes full fledged money changers, money transfer service providers, and casinos under its reporting regime.

- The act has conferred the powers upon the Director to call for records of transactions or any additional information that may be required for the purposes of investigation. The Director may also make inquiries for non-compliance of the obligations of the reporting entities.

- The Prevention of Money Laundering Act, 2002 levied a fine up to Rs 5 lakh. The amendment act has removed this upper limit .

- The act has provided for provisional attachment and confiscation of property of any person (for a period not exceeding 180 days).

2nd ARC Recommendations on Prevention of Money Laundering

- The Prevention of Money-laundering Act (PMLA) may be suitably amended at an early date to expand the list of predicate offences to widen its scope and outreach.

- The stage at which search and seizure action may be taken under the PMLA may be advanced in cases involving wider ramifications. Adequate safeguards may also be put in place in such cases.

- It may be examined whether institutional coordination mechanisms between the Directorate of Enforcement and other intelligence collecting and investigating agencies, could be strengthened and some provisions of the PMLA delegated to them by the Enforcement Directorate.

- The financial transaction reporting regime under the Financial Intelligence Unit (FIU-IND) may be extended to cover high risk sectors such as realestate. There is also need to strengthen the capacity of FIU-IND to enable it to meet future challenges.

- It would be useful to utilize the platform provided by the Regional Economic Intelligence Councils (REICs) for increased coordination among various investigation agencies in cases which are suspected to be linked with money laundering.

Black Money

White Paper on Black Money

The Finance Minister tabled the White Paper on Black Money in the Lok Sabha on May 21, 2012. According to the Paper, black money is a serious issue because it has a ‘debilitating effect’ on governance and public policy and this affects the poor disproportionately.

The Paper defines black money as: ‘assets or resources that have neither been reported to the public authorities at the time of their generation nor disclosed at any point of time during their possession’.

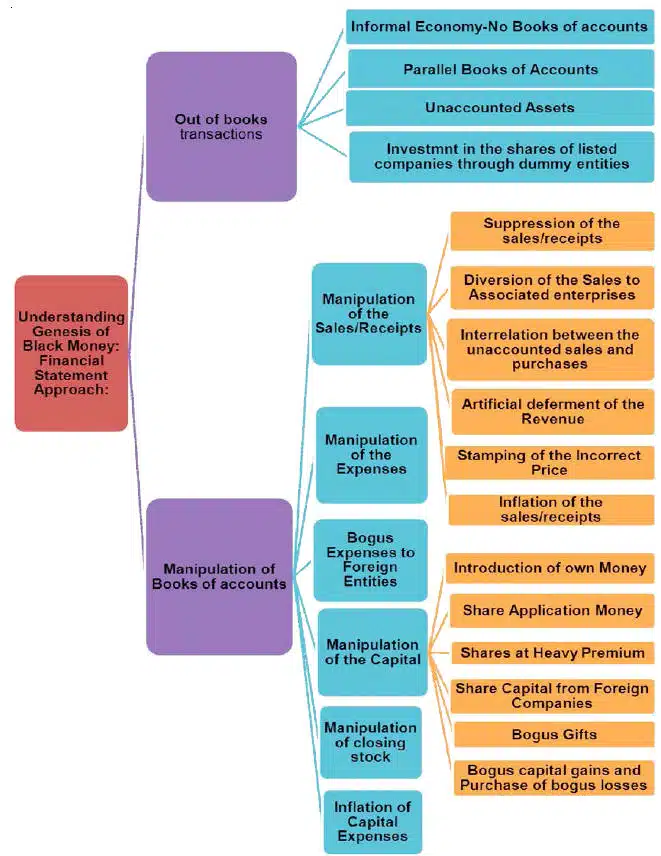

Black money can be generated through (i) illegal activities like crime , drug trade, terrorism and corruption or (ii) failing to pay dues to the public exchequer in one form or another. In the second case, activities might be legal but the perpetrator may simply have failed to report the income generated to avoid paying tax.

Certain sectors are highlighted as being more vulnerable to black money issues like land and real estate, bullion and jewelry, financial markets, public procurement, the non-profit sector, informal sector and cash economy. The Paper highlights the issue of Indian assets held abroad, particularly in Swiss banks. In 2017, liabilities in Swiss Banks towards India were Rs 7,005 crore and this was 0.05% of Swiss banks’ total liabilities.

The institutions currently responsible for dealing with black money issues are the Central Board of Direct Taxes (CBDT) , the Enforcement Directorate (ED), the Financial Intelligence Unit (FIU-IND) and the Central Board of Indirect Taxes (CBIT). The Central Economic Intelligence Bureau (CEIB) , the National Investigation Agency (NIA), and the High Level Committee (HLC) act as coordinating agencies.

The Government of India has employed the following framework to tackle black money. It is a fivefold strategy, namely:

- (i) joining the global crusade against black money

- (ii) creating an appropriate legislative framework

- (iii) setting up institutions for dealing with illicit money

- (iv) developing systems for implementation

- (v) imparting skills to personnel for effective action.

The Paper proposes a strategy to curb black money generation from legitimate activities based on four pillars:

- Reducing disincentives against voluntary compliance – this could involve measures like rationalization of tax rates and reducing transaction costs by providing electronic and internet-based services to pay tax.

- Reforms in sectors vulnerable to generation of black money – For instance, in the area of real estate, the Paper proposes deducting tax at source on payments made on real estate transactions. In the cash economy, the Paper recommends that the Government provide tax incentives for use of credit/ debit cards.

- Creation of effective credible deterrence – policies should create enough disincentives for black money generation. The Paper believes the introduction of the Goods and Service Tax (GST) will be an important step in this process. Other measures proposed include strengthening the direct tax administration, strengthening of the prosecution mechanism and enhancing exchange of information.

- Supportive measures – Paper include creating public awareness and public support , enhancing the accountability of auditors and participating in international efforts. With regards to repatriation of money overseas, the Paper suggests a onetime partial benefit of immunity from prosecution for voluntary disclosure.

Recommendations of SIT to Control Money Laundering

- Misuse of exemption on Long Term Capital gains tax for money laundering:

- Securities and Exchange Board of India (SEBI) needs to have an effective monitoring mechanism to study any unusual rise in stock prices of Companies while such a rise is taking place. With effective and timely monitoring by SEBI a significant number of such instances can be curbed in time.

- Once any such instances are detected, SEBI should invariably share this information with Central Board of Direct Taxes (CBDT) and Financial Intelligence Unit (FIU).

- Barring such entities from securities market would not be a strong deterrence in itself. In case it is established, that stock platforms have been misused for taking Long Term Capital Gain tax benefits, prosecution should invariably be launched under relevant sections of Securities and Exchange Board of India Act.

- Enforcement Directorate should then be informed to take action under Prevention of Money Laundering Act for the predicate offences.

- Misuse of Participatory notes (P notes) for money laundering:

- It is clear that obtaining information on “beneficial ownership” of P notes is of crucial importance to prevent their misuse.

- P notes are transferable in nature. This makes tracing the “true beneficial owner” of P notes even more difficult since layering of transactions can be made so complex so as to make it impossible to track the “true beneficial owner”. SEBI needs to examine if this provision of allowing transferring of P notes is in any way beneficial for easing foreign investment. Any investor wanting to invest through P notes can always invest afresh through a Foreign Portfolio Investor (FPI) instead of buying from a P note holder.

- Shell Companies and beneficial ownership:

- Proactive detection of creation of shell companies: Serious Frauds investigation office (SFIO) under Ministry of Company needs to actively and regularly mine the MCA 21 database for certain red flag indicators. Sharing of information on such high risk companies with law enforcement agencies: Once certain companies are identified through data mining above, the list of such high risk companies should be shared with CBDT and FIU for closer surveillance.

- In case after investigation/assessment by CBDT, a case of creating accommodation entries is clearly established, the matter should be referred to SFIO to proceed under relevant sections of IPC for fraud. It has also been observed that in many cases of creation of shell companies the shareholders or directors of such Companies are persons of limited financial means like drivers, cooks or other employees of main persons who intend to launder black money. Section 89(4) enjoins the Central Government to make rules to provide for the manner of holding and disclosing beneficial interest and beneficial ownership under this section. The Ministry of Company Affairs may frame such rules at the earliest.

- Action under PMLA for Trade Based Money laundering:

- SIT realizes that Trade Based Money laundering through mispricing of imports/exports is a major means of taking money out of this country. A strong deterrent action is needed to curb this menace. The SIT thus recommends that all cases of Trade based money laundering detected by DRI where violation of section 132 of Customs Act, above the threshold provided for in Part B of Schedule of PMLA, has been found must be shared by DRI with the Enforcement Directorate to enable ED to take action under Prevention of Money Laundering Act.

- Use of cash in Black economy:

- For regulating the possession and transportation of cash, particularly putting a limitation on cash holdings for private use and including provisions for confiscation of cash held beyond prescribed limits, provision in the Act should be made.

- Generation of black money in education sector and through donations to religious institutions and charities:

- Surveys conducted by the Department of various entities engaged in area of education through the Trust reveals that large unaccounted amount is accepted as donation and in a number of cases, such donations are used for personal benefits and also for tax evasion which results into generation of black money. Legislative change is required for curbing the generation and circulation of black money.

- Necessity for establishment of additional Courts for deciding the pending cases under the Income Tax Act, 1961.

- Establishment of Central KYC Registry: Setting up of this Central KYC Registry should be notified as early as possible which shall be an important office to tackle the menace of black money and money laundering more effectively.

- Generation of black money due to cricket betting: Some appropriate legislative directions or rules or regulations are required to be put in place to curb the menace of such betting.

- Empowerment of DRI under section 20, 21 and 22 of SEZ Act: One limitation faced by Directorate of Revenue Intelligence (DRI) in investigating cases of misinvoicing or violations of Customs Act is that presently DRI is not empowered under section 20, 21 and 22 of the SEZ Act, to carry out investigation, inspection, search or seizure in the Special Economic Zone or Unit without prior intimation or approval of the Development Commissioner.

Steps Taken by Government to Curb Generation of Black Money

Black Money stored in foreign countries and government measures against them

- Undisclosed Foreign Income and Assets Act, 2015: The Undisclosed Foreign Income and Assets Act 2015 imposed a flat 30% tax on undisclosed foreign income and asset holders along with a penalty at rate of 100% during one time compliance disclosure window.

- Signing of Automatic Exchange of Information and tax information exchange agreements with countries like Switzerland: Automatic exchange of information involves the systematic and periodic transmission of “bulk” taxpayer information by the source country to the residence country concerning various categories of income (e.g. dividends, interest, etc.). The Automatic exchange of information was signed under the G20 framework and India is a signatory.

- Modifying Double Taxation Avoidance Agreements with countries like Mauritius: Government has restructured India-Mauritius DTAA by taking right to impose capital gains tax in India (source country). In this way, other DTAAs with countries like Singapore, Cyprus etc., also will get modified automatically.

- Putting more regulation on Participatory Notes: SEBI banned FPIs from the issue of Participatory Notes for investing in equity derivatives. The FPIs can issue Participatory Notes for hedging the equity shares held by them. Participatory Notes were mainly used to invest in Indian equity derivatives. Hence, the removal of Participatory Notes for subscribing equity derivatives will make the Participatory Notes route almost useless. Previously, the Participatory Notes were the major instrument for least disclosed foreign investors to make investment in the Indian stock market. SEBI has also proposed an increase in disclosure requirements and restricted transfer of participatory notes to curb money laundering. According to SEBI, the transfer of Participatory notes will be restricted and allowed only after prior consent of the issuer. This means that for every downstream transfer of a Participatory note, prior consent of the issuer would be needed SEBI also issued instructions on Know Your Customer (KYC) norms for P Notes subscribers, transferability of P Notes, reporting of suspicious transactions and periodic review of systems.

- Foreign Exchange Data transfer to investigation agencies: The Special Investigation Team on black money proposed the RBI to transfer foreign exchange transactions data to Enforcement Directorate (ED) and Directorate of Revenue Intelligence (DRI).

Fight Against Domestic Black Money

It is estimated that nearly 95% of the black income generated in India are stacked within the country via physical assets, real estate, illegal activities etc. The major initiatives against black money within India are:

- Income Disclosure Scheme 2016: Income Disclosure Scheme 2016, incorporated in Finance Act 2016, provided an opportunity to all persons who have not declared income correctly in earlier years to come forward and declare such undisclosed income. Such income will be taxed at rate of 30% plus a Krishi Kalyan Cess of 25% on the tax payable and a penalty at the rate of 25% of tax payable totalling to 45% of income declared.

- PAN has become Mandatory for high value transactions: Permanent Account Number (PAN) is now quoted compulsorily for all transactions above Rs. 2 lakh from January 2016 and will be applicable on all sale and purchase of goods and services and for all modes of payment.

- Amendment to Benami Property Prohibition (Amendment) Act 2016: The Amendment act seeks to:

- (i) broaden the definition of benami transactions,

- (ii) establish adjudicating authorities and an Appellate Tribunal to deal with benami transactions, and

- (iii) specify the penalty for entering into benami transactions to deal more strictly and effectively with such activities.

- Demonetisation of Rs 500 and Rs 1000 notes: Demonetisation of Rs 500 and Rs 1000 notes was done in Nov 2016 to eliminate black money stacked in cash, reduce terror funding and check counterfeit currency menace.

- Promotion of cashless transaction: The government and RBI took several initiatives to promote cashless transactions like reduction of transaction charges on card based payment, BHIM App, UPI, AadhaarPay, lucky draw etc.

- Putting limit on physical cash settlement: Transaction relating to one event or occasion from a person is limited upto Rs 2 lakh in cash, for higher amount one need to use cheque or other digital medium. Restriction on receipt of cash donation reduced to Rs 2000 from Rs 20,000 for a political party.

- Tax Administration measures: Aadhaar – PAN linkage, Aadhaar mandatory for application of new PAN and filing of IT Return, reduction in presumptive tax for small unorganised business from 8% to 6% for amount of turnover realised through cheque or digital mode.

- Constitution of the Special Investigation Team: Constitution of Supreme Court monitored Special Investigation Team on Black Money to deal with menace of Black money.

- The Central Economic Intelligence Bureau: The Central Economic Intelligence Bureau and Financial Intelligence Unit were set up with the intention to make economic intelligence, monitoring and fighting economic offences such as smuggling, money laundering tax evasion and fraud.

- Initiation of ‘Project Insight’: Finance Ministry has launched ‘Project Insight’ to monitor high value transactions and detect tax evaders using state of the art technology in order to curb circulation of black money.

- Government imposed penalty on real estate cash transactions above Rs 20,000: The government has imposed a penalty of 20% on all cash transactions exceeding Rs 20,000 in purchase or sell of real estate property. Tax collected at source on cash sales exceeding Rs 2 lakh: To curb high value transaction and create an audit trail a tax collected at source with nominal rate of 1% has been imposed for all cash transactions above Rs . 2 lakh.

NGOs and FCRA

- NGOs are regulated under Foreign Contribution Regulation Act (FCRA) and Foreign Exchange Management Act (FEMA). The Home Ministry monitors foreign funds donated to NGOs through the FCRA while, FEMA is regulated by the Finance Ministry.

- According to the FCRA, any NGO that accepts foreign contribution has to register with the Home Ministry and such contributions can only be accepted through designated banks.

- The NGO has to report to the central government any foreign contribution within 30 days of its receipt. They need to file annual reports with the Home Ministry. It must also report the amount of foreign contribution, its source, how it was received, the purpose for which it was intended, and the manner in which it was utilized.

- In a case of non-compliance with provisions of the FCRA, the government can penalize an NGO. For example, if these NGOs don’t file annual returns, the government can issue a show-cause notice and subsequently, suspend or cancel their foreign funding licenses.

- But, there are certain NGOs which are registered under FEMA and they disburse foreign funds to various associations within the country.

- According to FEMA Act, these NGOs are regulated by Finance Ministry. For example, International donors such as the Ford Foundation etc. are registered under FEMA not FCRA. This makes it difficult to monitor the flow of funds effectively.

- The Home Ministry has asked the Finance Ministry to surrender its powers to monitor NGOs under FEMA. This move is aimed at bringing all NGOs which receive foreign contributions under one umbrella for better monitoring and regulation. It will help in better regulation of such funds.

International Initiatives

Vienna Convention

Deeply concerned by the magnitude of and rising trend in the illicit production of and trafficking in narcotic drugs, and recognizing that this trend could only be reversed through a coordinated action within the framework of international cooperation, the U.N. Commission on Narcotic Drugs convened a conference in Vienna, Austria to consider the adoption of a multilateral treaty (United Nations Convention against Illicit Traffic in Narcotic Drugs and Psychotropic Substances (1988)) to combat international drug trafficking.

Financial Action Task Force

The Financial Action Task Force (FATF) is an intergovernmental body established in July 1989 by Ministers of its member jurisdictions in Paris, initially to examine and develop measures to combat money laundering.

Significance for India: Indian has become a full fledged member of Financial Action Task Force (FATF). FATF membership is very important for India in its quest to become a major player in the International finance. It will help India to build the capacity to fight terrorism and trace terrorist money and to successfully investigate and prosecute money laundering and terrorist financing offences. India will benefit in securing a more transparent and stable financial system by ensuring that financial institutions are not vulnerable to infiltration or abuse by organized crime groups. The FATF process will also help us in co-ordination of Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) efforts at the international level.

Financial Intelligence Units

Recent efforts to develop effective strategies for antimoney laundering and combating the financing of terrorism by bring together several distinct but related aspects of financial systems and criminal law. Financial Intelligence Units (FlUs) constitute an important component of these strategies. An FIU is a central national agency responsible for receiving, analysing, and transmitting disclosures on suspicious transactions to the competent authorities.

Palermo Convention

- The United Nations Convention against Transnational Organized Crime (Palermo Convention), adopted by General Assembly resolution on 15th November 2000, is the main international instrument in the fight against transnational organized crime. The Convention is further supplemented by three Protocols, which target specific areas and manifestations of organized crime:

- The Protocol to Prevent, Suppress and Punish Trafficking in Persons’ Especially Women and Children

- The Protocol against the Smuggling of Migrants by Land, Sea and Air

- The Protocol against the Illicit Manufacturing of and Trafficking in Firearms, their Parts and Components and Ammunition.

- States that ratify this instrument commit themselves to taking a series of measures against transnational organized crime, including the creation of domestic criminal offences (participation in an organized criminal group, money laundering, corruption and obstruction of justice); the adoption of new and sweeping frameworks for extradition, mutual legal assistance and law enforcement cooperation; and the promotion of training and technical assistance for building or upgrading the necessary capacity of national authorities. All these in turn will help reduce generation of Black Money.

Amazing ! TYSM. Keep adding such quality content much appreciated!

Sure, Keep Reading