In this article, You will read everything about Disinvestment and Privatisation in India – for UPSC IAS.

Disinvestment

- Disinvestment can also be defined as the action of an organization (or government) selling or liquidating an asset or subsidiary. It is also referred to as ‘divestment’ or ‘divestiture.’

- In most contexts, disinvestment typically refers to the sale from the government, partly or fully, of a government-owned enterprise.

- A company or a government organization will typically disinvest an asset either as a strategic move for the company or for raising resources to meet general/specific needs.

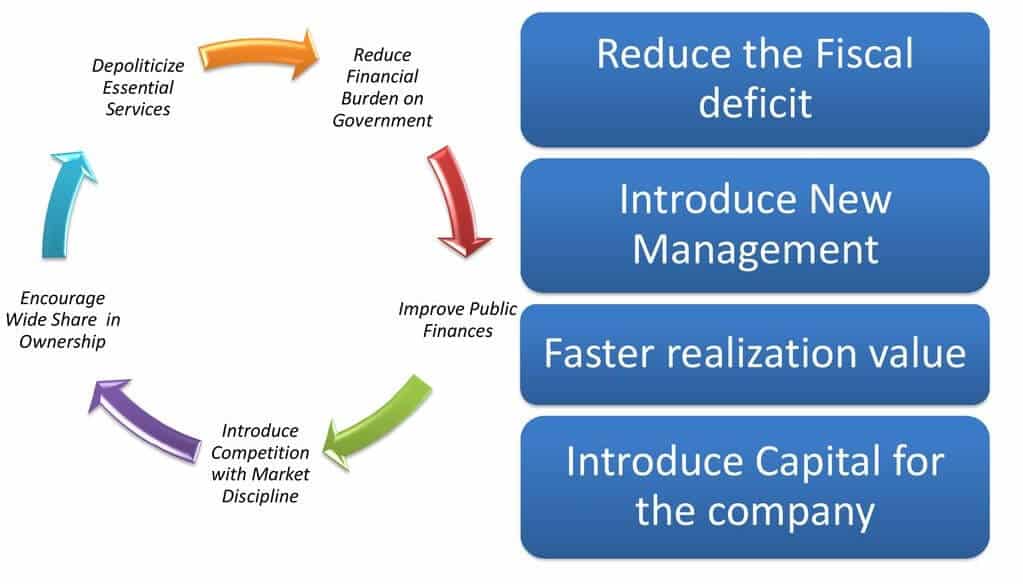

Objectives of Disinvestment

- To reduce the financial burden on the government

- To improve public finances

- To introduce, competition and market discipline

- To depoliticize non-essential services

- To encourage a wider share of ownership

- For fund growth

Benefit of Disinvestment

- Improves corporate governance: It would result in introduction of corporate governance in the privatized companies by freeing the PSEs from the Government control and give more scope to innovation. Enhanced corporate and with the introduction of independent Directors.

- Develops and deepens the capital market through spread of equity culture. The disinvestment would benefit the small investors and employees as it would lead to a wider distribution of wealth in the form of public offerings of privatized companies.

- Disinvestment funds can be utilised for long-terms goals such as:

- Financing large-scale infrastructure development.

- Investing in the economy to encourage spending

- Expansion and Diversification of the firm

- Repayment of Government Debts: Almost 40-45% of the Centre’s revenue receipts go towards repaying public debt/interest

- Investing in social programs like health and education

- This also creates fiscal space for relocation of resources locked with CPSEs. Disinvestment also assumes significance due to the prevalence of an increasingly competitive environment, which makes it difficult for many PSUs to operate profitably. This leads to a rapid erosion of the value of the public assets making it critical to disinvest early to realize a high value.

- Resources locked in sectors developed enough to raise money from the market are channelized into areas of economy that are less likely to access resources for the market because of their stage of economic development. Letting go of these assets is best in the long term interest of the tax payers as the current yield on these investments in abysmally low.

- Unlocking of shareholder value: It is done with the help of issuing IPO. IPO means Initial Public Offering. It is a process by which a privately held company becomes a publicly-traded company by offering its shares to the public for the first time. Offering an IPO is a money-making exercise. Every company needs money for expansion, to improve their business, to better the infrastructure, to repay loans, etc.

- Employees: Employees of a firm are benefitted by disinvestment through:

- Pay rises, which has been done in past disinvestments.

- Greater opportunities and avenues for career growth and further employment generation through capacity expansion.

Disinvestment Types

- Minority disinvestment

- A minority disinvestment is one such that, at the end of it, the government retains a majority stake in the company, typically greater than 51%, thus ensuring management control.

- Examples of minority sales via auctioning to institutions go back into the early and mid 90s. Some of them were Andrew Yule & co. Ltd., CMC Ltd etc. Examples of minority sales via offer for sale include recent issues of power Grid Corp. Of India Ltd., Rural Electrification corp. Ltd., NTPC Ltd., NHPC Ltd. Etc.

- The present government has made a policy statement for FY 2018-19 that all disinvestments would only be minority disinvestments through public offerings.

- Majority disinvestment

- A majority disinvestment is one in which the government, post disinvestment, retains a minority stake in the company i.e. it sells off a majority stake.

- Historically, majority disinvestments have been typically made to strategic partners. These partners could be other CPSEs themselves, a few examples being BRPL to IOC, and KRL to BPCL.

- Alternatively, these strategic partners can be private entities, like the sale of Modern Foods to Hindustan Lever Ltd., CMC to Tata Consultancy Services Ltd. (TCS).

- Also, same as in the case of minority disinvestment, in majority disinvestment cases the stake can also be offloaded by way of an Offer for Sale, separately or in conjunction with a sale to a strategic partner.

- Complete privatization

- Complete privatization is a form of majority disinvestment wherein 100% control of the company is passed on to a buyer. Examples of this include 18 hotel properties of ITDC and 3 hotel properties of HCL.

- Disinvestment and privatization are often loosely used interchangeably. There is, however, a vital difference between the two. Disinvestment may or may not result in privatization.

- When the government retains 26% of the shares carrying voting powers while selling the remaining to a strategic buyer, it would have disinvested, but would not have ‘privatized’, because, with 26%, it can still stall vital decisions for which generally a a special resolution (three-fourths majority) is required.

Privatization and disinvestment

- Privatization implies a change in ownership, resulting in a change in management. The privatization of public sector enterprises will occur only when govt. sells more than 51% of its ownership to private entrepreneurs.

- Disinvestment, on the other hand, has a much wider connotation as it could either involve dilution of govt. stake to a level that results in a transfer of management or could also be limited to such a level as would permit govt. to retain control over the organization.

- Disinvestment beyond 50% involves the transfer of management, whereas disinvestment below 50% would result in the govt. continuing to have a major say in the undertaking.

Criteria for disinvestment

- Whether the objectives of the company are achieved.

- Whether there is decrease in number of beneficiaries.

- Whether serving the national interest will be affected because of disinvestment

- Whether private sector can efficiently operate and manage the undertaking.

- Whether the original rate of return targeted could be possible to achieve or not

Modalities of disinvestment

In order to achieve the various objectives and goals of disinvestment many methods

have been formulated and implemented. These includes:

- Public offer: Offering shares of public sector enterprises at a fixed price through the general prospectus, the offer is made to the general public through the medium of recognized market intermediaries.

- Cross holding: In the case of cross-holding, the govt. would simply sell part of its share of one PSU to one or more PSUs.

- Golden share: In this model, the govt. retains a 26% share in the PSU. This 26% share will continue to give the govt. The status of the majority shareholder.

- Warehousing: Under this model, the govt. owned financial institutions were expected to buy the govt‘s share in select PSUs and holding them until a third buyer emerged.

- Strategic sale: Under this model, govt. sells a major portion (51% and above) of its stake to the strategic buyer and also gives over the management control.

- Follow on Public Offering: It refers to issuing of shares to investors by a public company that is already listed on an exchange. Retail participation is mostly high in FPOs.

- Offer for Sale: The features of OFS is given below:

- The size of the offer shall be at least 1% of the paid-up capital of the company, subject to a minimum of Rs 25 crores.

- Seller(s) may declare a floor price in the announcement/notice.

- The duration of the Offer for Sale shall not exceed one trading day.

- A separate window for the purpose of Offer for Sale of shares shall be created by stock exchanges.

- The stock exchange shall collect 100% of the order value in cash, at the order level for every buy order/bid.

- Institutional placement program

- An institutional placement program refers to the issuance of fresh shares and offers for the sale of shares in a listed issuer for the purpose of achieving minimum public shareholding.

- The minimum number of allottees for each offer of eligible securities made under the institutional placement program shall not be less than ten.

- No partly paid-up securities shall be offered.

- The issue shall be kept open for a minimum of one day or a maximum of two days.

- Institutional placement programs must not result in an increase in public shareholding by more than ten percent.

- Allottee cannot sell the allocation/allotment before the period of one year.

Merits of disinvestment

- Reduce the burden on the government: Disinvestment of loss Making PSU’s, would help the government to invest in profit-making PSU’s which will minimize the burden on the government

- In the private sector, the decision-making process is quick and decisions are linked with the competitive market changes.

- The disinvestment process would bring in better corporate governance, exposure to competitive corporate responsibility, improvement in the work environment, etc.

- The market participation in the capital of PSUs through stock exchanges would enable the market to discover the latent worth of PSUs.

- The loss-making PSUs can be successfully revived by asking the strategic partner to infuse fresh capital and exercising excellent management control over sick PSUs.

Demerits of disinvestment

- Selling of profit-making and dividend-paying PSU would result in loss of a regular source of income to the government.

- There would be chances of ‘asset stripping’ by the strategic partner. Most of the PSUs have valuable assets in the shape of plants and machinery, land and buildings, etc.

- The government’s policy or disinvestment includes the disposal of both profit-making, as well potentially viable PSUs.

- Strategic and National Security Concerns: Strategic Disinvestment of Oil PSUs is seen by some experts as a threat to National Security since Oil is a strategic natural resource and possible ownership in the foreign hand is not consistent with our strategic goals.

- Raising funds from disinvestment to bridge the fiscal deficit is an unhealthy and short-term practice. It is said that it is the equivalent of selling ‘family silver to meet short-term monetary requirements.

National investment fund

- On 27 January 2005, the government had decided to constitute a ‘national investment fund’ (NIF) into which the realization from sale of minority shareholding of the government in profitable CPSEs would be channelized.

- Until 2008-09, 75 percent of the funds under NIF were spent on selected central social welfare schemes (on health, education, employment etc.) and 25 percent of the funds were to be used to meet the capital requirements of profitable PSUs.

- Due to the economic difficulties created by the global economic recession, the government decided to utilize 100 percent of NIF funds for social welfare schemes until 2013.

- At present, the funds under NIF exist as a ‘Public Account’ which is outside the Consolidated Fund of India. The funds under NIF are permanent in nature and remain until they are withdrawn or invested for approved purposes

- Salient features of NIF

- The proceeds from the disinvestment of CPSEs will be channelized into the national investment fund which is to be maintained outside the consolidated fund of India.

- The corpus of the national investment fund will be of a permanent nature.

- The fund will be managed professionally, without depleting the corpus.

- 75% of the annual income of the fund will be used to finance selected social sector schemes, which promote education, health, and employment. The residual 25% of the annual income of the fund will be used to meet the capital investment requirements.

- Fund managers of NIF

- UTI asset management co.LTD.

- SBI funds management co. PVT.LTD.

- LIC mutual fund asset management co. LTD.

Policy on disinvestment

- Citizens have every right to own part of the shares of central public sector enterprises. This is done through IPOs and FPOs.

- Central public sector enterprises are the wealth of the nation and this wealth should rest in the hands of the people.

- While pursuing disinvestment, the majority shareholding of a least 51% and management control of the central public sector enterprises to be retained by the government.

Arguments against disinvestment

- Government’s stakes in CPSEs would squeeze this important source of revenue for the government. Thus, essentially implying that the real beneficiaries would not be the ordinary retail investor but institutional investors.

- In the case of disinvestment, future streams of income from dividends are forgone against a one-time receipt from the sale of stakes.

- Employees of PSUs would lose jobs or benefits offered by the government.

Use of disinvestment proceeds

- 75% to finance selected social sector schemes, which promote education, health and employment.

- 25% to meet the capital investment requirements of profitable and revivable CPSEs that yield adequate returns, in order to enlarge their capital base to finance expansion/diversification.

- Accordingly, from April 2009, the disinvestment proceeds are being routed through NIF to be used in full for funding capital expenditure under the social sector programs of the government, namely:

- Mahatma Gandhi National Rural Employment Guarantee Scheme

- Indira Awas Yojana

- Rajiv Gandhi Gramin Vidyutikaran Yojana

- Jawaharlal Nehru National Urban Renewal Mission

- Accelerated irrigation benefits program

- Accelerated power development reform program

Factors responsible for low disinvestment in India

- Unfavourable market conditions

- Offers made by the government were not attractive for private sector investors

- Lot of opposition on the valuation process

- No clear-cut policy on disinvestment

- Strong opposition from employee and trade unions

- Lack of transparency in the process

- Lack of political will

- Generally, profit making companies will not be privatized.

- As per the National Common Minimum Programme (NCMP) the government retain existing ‘Navratna’ companies in the public sector.

- Loss making companies either sold off or closed, after all workers get their legitimate dues and compensation.

- The government has approved the constitution of a National Investment Fund (NIF) comprising of proceeds from disinvestment of public sector units

- The govt. has also given in principal approved for listing of currently unlisted profitable PSEs each with a net worth in excess of Rs.200 crore, through an initial public offer (IPO).

Disinvestment programs in PSE’s

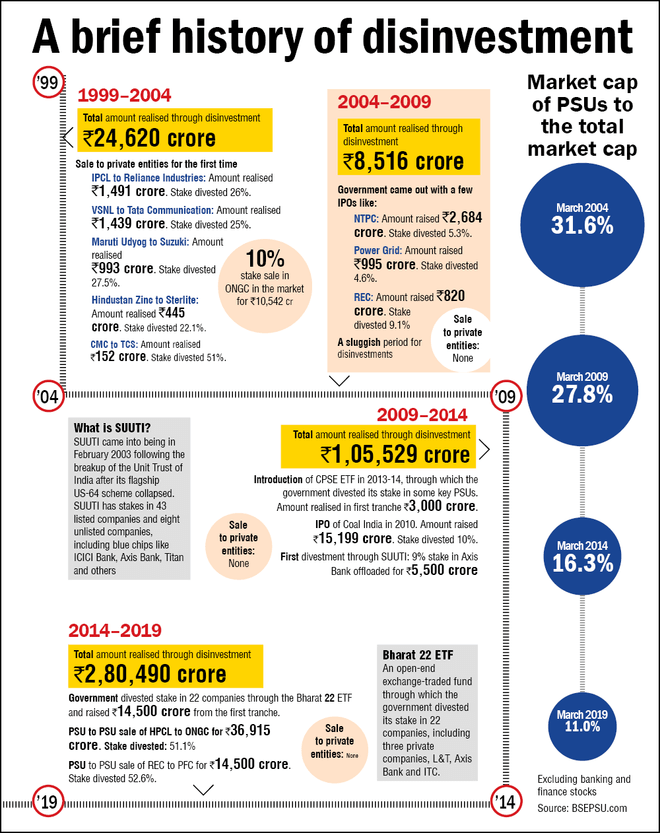

- The disinvestment process, which began in 1991-92 with the sale of a minority stake in some public sector undertakings

- The new policy in this regard is that the government is committed to a strong and effective public sector whose social objectives are met by its commercial functioning

- The govt. is committed to devolving full managerial and commercial autonomy to successful, profit-making companies operating in a competitive environment.

- Some of the PSUs in which disinvestment is done are: BHEL, BPCL, CONCOR, GAIL, HCL, SAIL, NTPC, NMDC, VSNL, MTNL.

Super

like it