- Recently, the Appointments Committee of the Cabinet (ACC) headed by the Prime Minister has decided to set up Financial Services Institutions Bureau (FSIB) as a replacement body of Bank Board Bureau.

- The Financial Services Institutions Bureau will select the chiefs of public sector banks and insurance companies.

- The FSIB will have the clear mandate to issue guidelines and select general managers and directors of state-run non-life insurers, general insurers and Financial Institutions.

- FSIB will be the single entity for making recommendations for appointments of WTD (Whole-time Director) and NEC (Non-executive Chairman) in Public Sector Banks, India Private Limited company and Financial Institutions.

- After getting approval from ACC, the Department of Financial Services (DFS) in the Ministry of Finance is expected modify certain provision in the Nationalised Banks (Management and Miscellaneous Provisions) Scheme of 1980.

- FSIB would be a professional body with autonomy in its affairs and shall have its own secretariat.

FSIB Responsibilities

- The FSIB will also advise the government on a suitable performance appraisal system for whole-time directors and non-executive chairmen of the state-run financial services institutions.

- The body will build a data bank relating to the performance of public-sector banks (PSBs), FIs and insurance companies.

- It will advise the government on “formulation and enforcement of a code of conduct and ethics for whole-time directors” in these institutions.

- The FSIB will even help these state-run banks, FIs and insurers in developing business strategies and capital raising plans, etc.

FSIB members

- The FSIB will comprise

- a chairperson nominated by the central government;

- the secretaries of the departments of financial services and public enterprises;

- the chairman of the Insurance Regulatory and Development Authority of India; and

- a deputy governor of the Reserve Bank of India (RBI).

- Apart from them, there will be three members with knowledge of banks and other financial institutions, and three more with knowledge of insurance.

- In future, the FSIB chairman and the three members handling affairs relating to banking and financial institutions will be selected by a search committee that will comprise the RBI governor and the secretaries of the departments of financial services and personnel and training.

Banks Board Bureau (BBB)

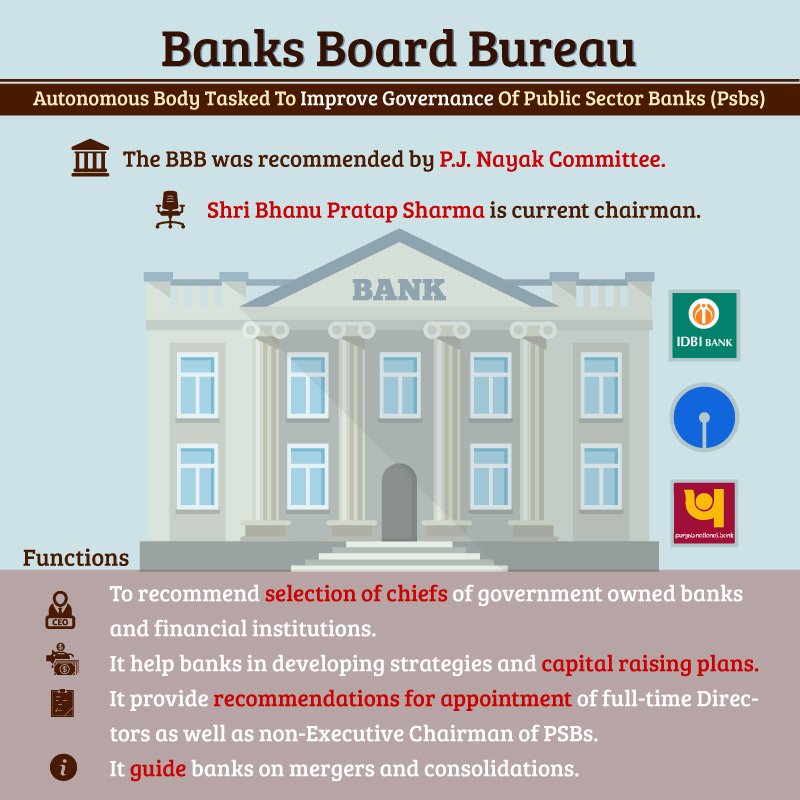

- The Banks Board Bureau (BBB) has its genesis in the recommendations of ‘The Committee to Review Governance of Boards of Banks in India, May 2014 (Chairman – P. J. Nayak)’.

- The government, in 2016, approved the constitution of the BBB to make recommendations for appointment of whole-time directors as well as non-executive chairpersons of Public Sector Banks (PSBs) and state-owned financial institutions.

- It was an autonomous recommendation body.

- The Banks Board Bureau was a public authority as defined in the Right to Information Act, 2005.

- The Ministry of Finance has the final decision-making authority on the appointments in consultation with the Prime Minister’s Office.

Functions:

- Apart from recommending personnel for the PSBs, the Bureau had also been assigned with the task of recommending personnel for appointment as directors in government-owned insurance companies.

- It was also entrusted with the task of engaging with the board of directors of all PSBs to formulate appropriate strategies for their growth and development.

PYQ. The Chairmen of public sector banks are selected by the (2019)

(a) Banks Board Bureau

(b) Reserve Bank of India

(c) Union Ministry of Finance

(d) Management of concerned bank

Ans: (a) Banks Board Bureau